Asset Management

Swiss Private Bank Adds Trio Of Crypto-Currencies To Its Roster

Falcon first announced its blockchain-powered trading service last month.

Swiss private bank Falcon has made a deeper foray

into the burgeoning crypto-currency space, announcing it will add

ethereum, litecoin and bitcoin cash to its roster of digital

assets next week.

As of August 22, Falcon clients will be able to exchange and hold

the trio of crypto-currencies, all of which were developed more

recently than bitcoin, the most well-known digital

coin.

The firm announced last month that it was the first Swiss private

bank to provide blockchain-powered asset management, initially

enabling its clients to buy and sell bitcoin using cash

holdings.

“We are pleased to add ethereum, litecoin and bitcoin cash to our

services just a month after introducing blockchain asset

management solutions with bitcoin,” Arthur Vayloyan, global head

of products and services at Falcon, said. “The first reactions to

our bitcoin services have been very encouraging and we are

convinced that by adding three new blockchain assets we will

fulfil our clients’ future needs.”

A blockchain is a virtual distributed ledger of transactions

shared peer-to-peer that can record ownership across a public

network of computers rendered tamper-proof by advanced

cryptography.

The technology is causing a stir within the financial services

sector as its supporters believe it could reduce hidden expenses

in the financial system by ousting inefficiencies across areas

such as payments, syndicated loans and equity clearing.

Although blockchain rose to fame as the platform underpinning the

controversial digital currency bitcoin, its uses are incredibly

wide reaching.

Like bitcoin, ethereum, litecoin and bitcoin cash transactions

are all enabled by blockchain technology.

However, the three have so far failed to snatch the limelight

from bitcoin, which has gathered unprecedented momentum since it

was born in 2009.

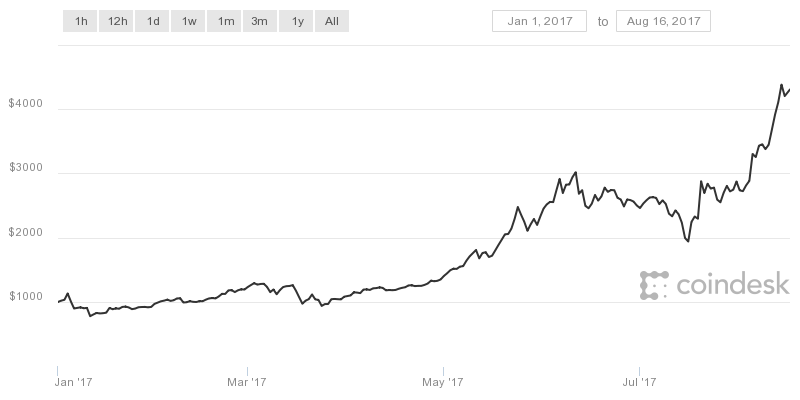

Since the start of 2017, bitcoin’s price has rocketed from just

under $1,000 to over $4,300. The crypto-currency has a

market cap of $68 billion.

Graph illustrating the fluctuating price of bitcoin

since January

Ethereum has also prospered, albeit not to the same extent as

bitcoin, its price having surged from around $8 in January this

year to just shy of $300 now.

Bitcoin cash, which was created earlier this month to scale

bitcoin to more users while improving transaction capabilities,

was trading at $303.51 (August 16, 2017, 16:16pm), up 1.76 per

cent.