The main takeaways from Berkshire Hathaway’s AGM had little to do with investment, says Michael Crawford (pictured), CIO of , a UK-based boutique asset management firm. Crawford has been regularly attending Warren Buffett’s presentations at the annual meetings. A key message, the author said he heard, is "attract the right kind of shareholders and work with people you could share your last day with."

The editors are pleased to share this commentary; the usual disclaimers apply. To respond, email tom.burroughes@wealthbriefing.com

It has been 16 years since I first flew into Omaha’s Eppley airport on my way to the annual general meeting of Berkshire Hathaway. My feelings this year, as the plane lined up for its final approach, were no different from the first; a sense of calmness and rationality started to wash through me.

This year was different though, as Warren Buffett’s long-time partner, Charlie Munger, passed away at the end of 2023; a huge loss for the company. I wondered how this would personally affect the sage; for the first time at this event, I felt a tinge of sadness.

In 2008, when I first came, I was motivated to see Buffett before it was too late as he and Charlie were way beyond the normal retirement date of the most tenacious company leaders. However, I realised the occasion, as well as adding to my knowledge of Buffett’s investment philosophy and approach, acted as a reset after the noise and hype of a typical 12 months in the life of a fund manager. On top of this, despite having a good knowledge of Buffett’s investment philosophy and achievements, I have normally come away with at least two new learning points at each meeting.

After a fitting tribute to Charlie displayed through the video traditionally shown as the meeting commences, Buffett reverted to his normal business persona. A touching moment occurred soon after as he completed an answer to a question and instinctively said, “Over to you Charlie.” A collective sigh of despair emanated from the 40,000 attendees.

Fittingly, and perhaps by Warren’s design, the two takeaways for me this year are more ethical than business-related. The first was encapsulated in an additional 30-second video showing an audience of students at the Albert Einstein College of Medicine in the Bronx, New York, cheering ecstatically. Ruth Gottesman, whose deceased husband was an early investor in Berkshire, had just announced a gift of $1 billion of Berkshire stock meaning the school will become tuition-free for all medical students.

Buffett cited this as an example of the integrity of the type of shareholders Berkshire attracts and who, in the early days, were mainly individuals. Many of these initial investors have since made donations of hundreds of millions to their local communities and charities. This requires a long-term commitment to the investment which in turn requires sacrifices in deferred consumption. They allowed Buffett the freedom to invest long-term as he saw fit.

He contrasted these philanthropists with the anonymous investors in index and hedge funds where you are unlikely to see such an outcome. For me, as a recent founder of a boutique manager, Chawton Global Investors, the learning point is that the character of the investor base I recruit now will be a key factor in our future success. We need to focus our marketing on those with a long-term mindset who understand that investment is about business fundamentals and integrity.

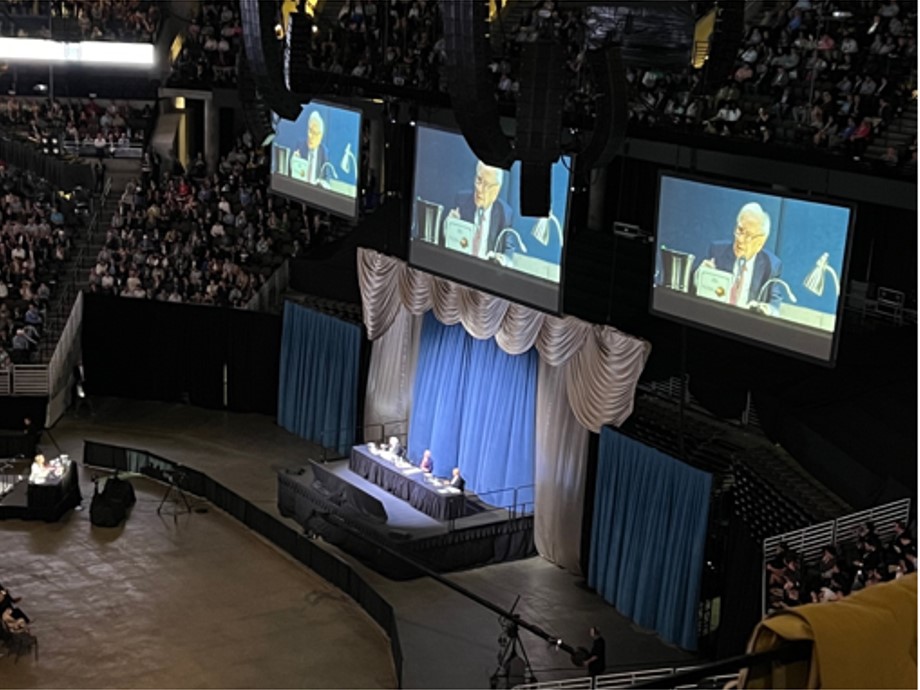

The AGM

The second takeaway pertained to Charlie and the bond he and Warren developed. Asked by a very young investor, if they could have had one more day together, how they would have spent it, Warren developed his answer to highlight the importance of identifying those few people that are very important to one both personally and in business and developing those relationships. In other words, those people you would like to spend your last day with.

The partnership with Charlie enabled the success of Berkshire as he provided complementary qualities to add to Buffett’s genius. Most notably his interests were much broader than Warren’s, extending to many disciplines beyond investment. Infamously, he also had a different take on Ben Graham emphasising quality combined with value which shifted the whole approach of Berkshire soon after it was acquired.

As I thought about this, I realised that I have people I value both working in or closely connected to Chawton where I could do much more to develop my relationship. Selecting one or two of these to be our “Munger” is likely to be a key part of our success.

The weekend passed all too quickly and included visits to the thriving jewellery outlet, Borsheims and the gigantic discount store, Nebraska Furniture Mart, both examples of great businesses Berkshire owns. As I packed my suitcase with the scrumptious See’s Candy also part of the group, as well as feeling fully reset, my sadness as we approach the end of an era turned to elation. Buffett and Munger’s achievements will endure long after they have gone: both through Berkshire and the many investment and company managers they have influenced.