Technology

Crypto-Currencies: How The Mighty Have Fallen

At a time when the outlook seems bleak for the crypto-currency market, blockchain aficionados share their views with this publication.

Could this be the beginning of the end for crypto-currencies? Is

the bubble about to burst?

Hundreds of billions of dollars have drained from the

crypto-currency market as fears of an escalated regulatory

crackdown in China sparked a mass sell-off.

A back-of-the-envelope calculation using data from

CoinMarketCap shows that the top-ten crypto-currencies

have had around $313 billion shaved off their market

capitalisation since 7/1/18, with bitcoin taking the biggest hit

as its market value plummeted $119 billion. In total, there are

1,442 digital currencies in circulation with a market cap of

around $465 billion. (By the time of publication, however, these

figures will likely be outdated due to fierce market

turbulence.)

The plunging prices of crypto-currencies across the board began

earlier this week after reports emerged suggesting that

China would clamp down further on its crypto-currency trade,

banning access to offshore digital currency exchanges just months

after the nation forced domestic equivalents to shut shop. The

Chinese government’s plan has sparked hysteria in the global

market, spurring jittery investors to cash out before losses

become unbearable.

Because most online exchanges for so-called “alt coins” –

crypto-currencies that are less well-known than the likes of

bitcoin with a miniscule market cap in comparison – do not allow

users to purchase them using fiat currency, this means any

profits booked are effectively stored in another form of

crypto-currency, like bitcoin or ethereum, for example, until

they are converted back into fiat.

As a result, when the large crypto-currencies crash, any profits

that have not yet been converted back into fiat currency begin to

dwindle. This often prompts a selling frenzy that inevitably

drags the entire crypto market down.

This appears to be the case, according to Dan Novaes, founder of

Current, a blockchain-based platform

that aims to tokenise the music streaming industry.

“There are a lot of investors panic selling right now… this stuff

is volatile,” he said. “This is a product of inexperienced buyers

coming into the market over the past few months and seeing

nothing but gains. When things dip on news such as crackdowns, a

dip occurs that turns into even bigger dip because many are panic

selling.”

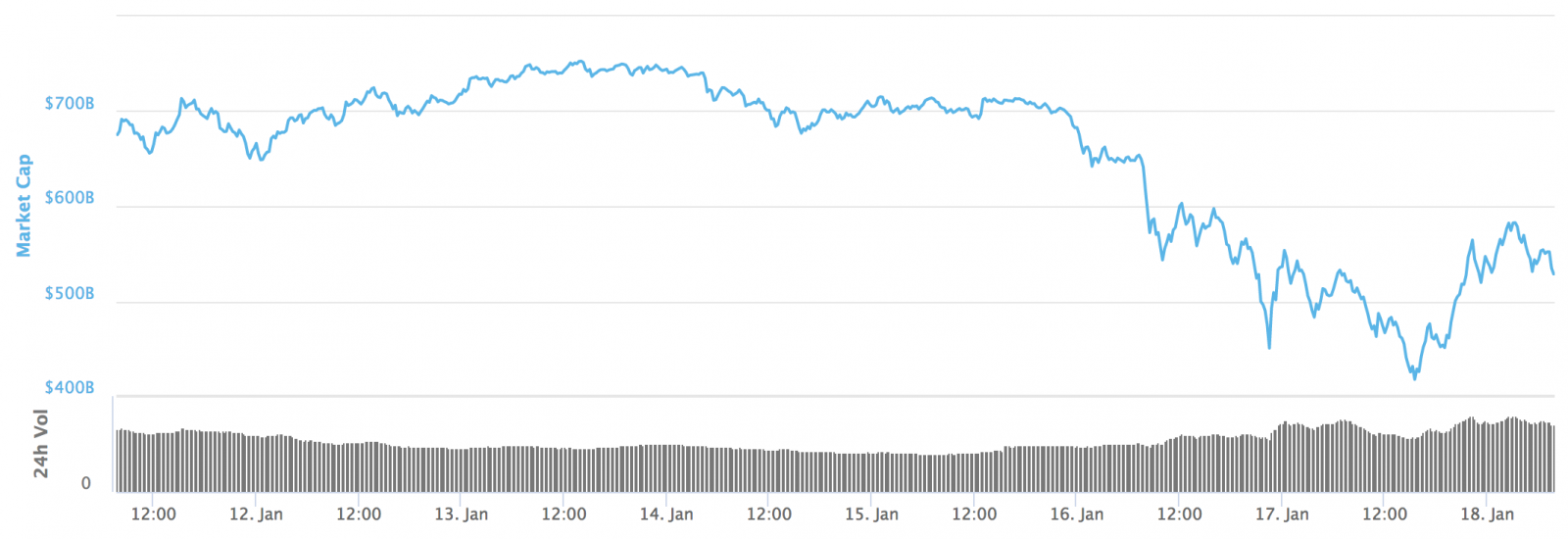

Source: CoinMarketCap.com

In December, bitcoin’s price reached over $20,000. At the time of

writing (16:00, 17/1/18), it was trading well below $10,000 and

the fall was not yet showing signs of slowing.

Despite losing around a quarter of their values in the past 48

hours, bitcoin, ethereum and ripple were still up 1,000 per cent,

8,500 per cent and 13,500 per cent, respectively, in the past 12

months.

Daniel Duarte Figueiredo, another crypto entrepreneur who

co-founded blockchain savings company Auctus, remains bullish on

bitcoin and expects its price will ultimately recover and could

reach unseen highs this year.

“The price dropped because of news related to China escalating

[its] crackdown on crypto-currencies and the correction is

normal,” he said. “Unless there is some really negative news

about the blockchain technology [which underpins crypto-currency

transactions], I believe that bitcoin will recover to its highest

values and might even break some new records later this

year.”

He also explained how bitcoin “is still the entrance to other

crypto-currency investments, as in a lot of countries bitcoin is

the only crypto-currency you can buy directly with local fiat

currencies”.

Generally speaking crypto-currencies “still have a lot to grow in

2018,” he added, although “maybe not as much as they did in 2017

in relative terms”.

Bitcoin’s value soared as much as 2,000 per cent over the course

of 2017, while the market cap of all crypto-currencies had

swelled from just $18 billion last January to exceed $750 billion

at its peak. It is unsurprising that the latest collapse has

given so many new investors cold feet.

Déjà vu

Yet, with bitcoin, we have been here before.

First came an unexpected, unexplained 1,000 per cent explosion.

Then, this was followed by a 50 per cent pullback just weeks

later.

This didn’t happen recently, but at the end of 2013 and the

beginning of 2014.

Of course, much has changed since; bitcoin now frequents the

headlines of mainstream news outlets and has transformed from a

niche thought to be used only by techies and surfers of the

so-called Dark Web to a day trader’s play thing after landing on

large exchanges used daily by Wall Street in the form of futures

contracts.

Still, the same lessons need to be learned: crypto-currencies are

a risky bet, and first-time investors looking to make a quick

buck would be wise to sleep on it before jumping in

feet-first.

The volatility of the crypto market, showcased so perfectly this

week, is a stark reminder of why regulators globally are keeping

a hawk’s eye on the sector, and helps explain why authorities in

the East, like in China and South Korea, are taking a tougher

stance.

Many may agree with the words of Pan Gongsheng, vice governor of

the People’s Bank of China, who this week said: “Pseudo-financial

innovations that have no relationship with the real economy

should not be supported.”

In the eyes of crypto-currency proponents, they are still the

future of money.

One thing is for certain, though: only time will

tell.