Asset Management

A New Twist On Smart Diversification - The Insurance Syndicate Path

.jpg)

This article argues that investing in the historic Lloyd's of London insurance market generates average annual returns of 10 per cent over the long run, but also gives real diversification by asset type and the business cycle.

The following article comes from Argenta Private Capital and concerns the well-trodden but crucial topic of diversification. The author is Robert Flach, managing director at Argenta Private Capital Limited.This article looks at what comes in investing in the Lloyd’s of London insurance syndicate market (this news service has looked at this topic before). While readers may think they’ve encountered every view possible on this topic, there is always a new way to frame discussions. The editors are pleased to share this content. The usual disclaimers apply. Respond by emailing tom.burroughes@wealthbriefing.com

Throughout 2022 and at the beginning of 2023 there was one word

that kept coming up in the conversations we were having with

investors and the investment management community:

diversification.

Building a portfolio diversified by asset type, geographic

exposure and sectors has always been critical for all types of

investors, but for family offices and high net worths who have

options in both private and public markets, the question becomes

more about which opportunities they should take up.

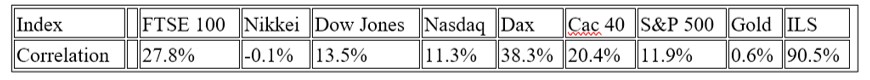

Investing at the historic Lloyd’s of London insurance market not

only generates average annual returns of 10 per cent* over the

long term, but it provides significant diversity by asset type

and economic cycle coupled with low correlation to other asset

classes**. In fact, when looking at the returns profile at

Lloyd’s, it has often performed best counter cyclically. For

example, in 2008 at the height of the global financial crisis

APCL achieved a 17.7 per cent return on funds in Lloyd’s,

followed by a 40.1 per cent return in 2009.

Investors at Lloyd’s of London pledge their capital to a pool of

around 90 specialist insurance syndicates, all of whom underwrite

a variety of different risks across the globe, comprising a range

of different business lines. While US Property has traditionally

been the largest class of insurance underwritten, investors will

often have exposure to a range of esoteric or emerging sectors

such as cyber risk, terrorism or fine art.

Whatever the class, the basic principle is the same across the

board: in good years, premiums exceed pay-outs and investors

profit, while in bad years, pay-outs exceed premiums, and a

limited loss is incurred***.

Current market conditions

Lloyd’s is currently during one of the hardest markets in years.

Insurance rates have risen for 21 consecutive quarters, with

rates in certain classes having increased as much as 37 per cent

year on year****. This leaves the insured paying more for their

insurance cover to the benefit of the syndicates and their

investors. Lloyd’s market result has recently been posted and is

91.9 per cent for 2022, or the equivalent of only paying out 91p

in claims and expenses for every £1 of premium received; in their

view, Lloyds's is about to experience its best returns since

2014.

Investing for the long-term

Family offices and high net worth individuals are uniquely placed

to benefit from the time horizons that are typically involved at

Lloyd’s. Investment vehicles set up at Lloyd’s are often

structured with the expectation that they’ll be passed through

generations, making them an ideal asset for those interested in

estate planning and the transition of wealth to the younger

generations.

Investors have the option to build bespoke investment vehicles

which are suitable to their individual set of circumstances,

whether that be from a risk or regulatory perspective.

Tax planning

And when looking at longer term investment horizons, the tax

treatment of these vehicles becomes an important factor, as it is

with any asset class. This is particularly pertinent as we

approach the beginning of April and the end of the UK tax year

when people’s minds are focused in on their tax bills.

Investors in the Lloyd’s of London market who are subject to UK

Inheritance Tax and have been invested in Lloyd’s for more than

two years qualify for Business Relief, which provides 100 per

cent relief for the value of the assets for Inheritance Tax

purposes, subject to meeting certain requirements. This has

obvious advantages for those looking to pass on assets to the

next generation and is a favourable tax treatment compared to

many asset classes.

A high net worth investment

Investing at Lloyd’s is an attractive option for family offices

and HNW individuals. To gain maximum benefit from it, investors

should look to invest a minimum of £1,000,000, accounting for no

more than 15 per cent of their total net worth.

*based on Argenta’s clients’ annualised average returns over the last 10 years

** These figures demonstrate the average returns since 2003

***Losses are limited to the capital pledged to the limited liability underwriting vehicle

**** Source The Marsh Market Index Global Insurance Market Index

2022 | Global Insurance Market Index | Marsh