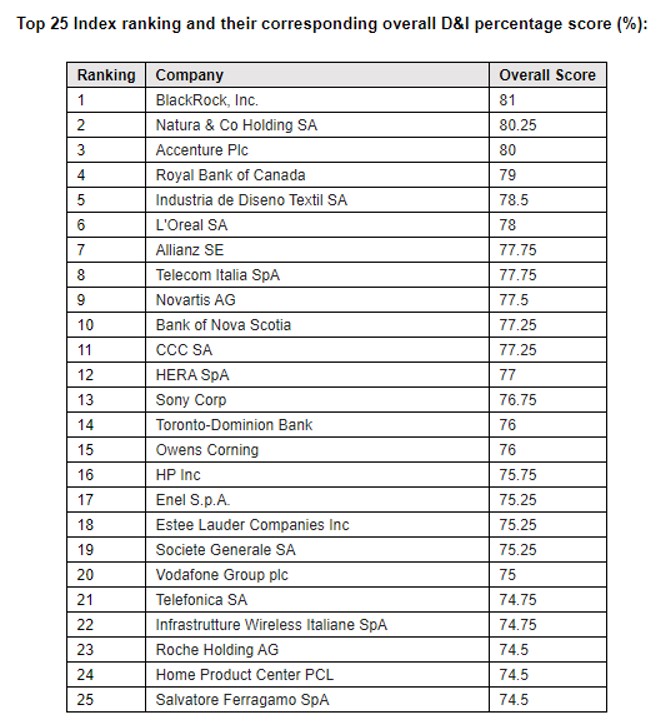

Statistics

BlackRock Tops Refinitiv Diversity, Inclusion Index

The fact that such an index exists testifies to how these qualities are being tracked by investors fired up by ideas about sustainability, social practices and transparency.

The world’s largest asset manager, BlackRock, Brazilian personal

care products firm Natura & Co, and accountancy and consultancy

firm Accenture score first, second and third for being the most

diverse and inclusive in the world, according to a ranking by

data and information services firm Refinitiv.

Industries leading the firm’s Diversity and Inclusion Index Top

100 are banking, investment services and insurance firms with a

total of 18, followed by pharmaceuticals with nine and

telecommunications services, specialist retailers and personal

and household products and services with seven respectively. The

US leads the Top 100 list with 20 firms followed by the UK with

13, Australia with nine and Canada and France with

seven.

The index ratings, which are informed by Refinitiv’s

environmental, social, and governance data, are designed to

measure relative performance of close to 10,000 companies

representing 80 per cent and more of global market cap across

more than 450 ESG data points, to provide clients with a critical

and differentiated insight. The Index was launched in 2016.

The publication of these figures highlights how qualities such as

diversity and inclusion are increasingly important selection

points for investors motivated by non-financial as well as

monetary concerns.

Refinitiv said the D&I Index rates and scores companies

across four main points: Diversity, inclusion, people development

and controversies. Only companies with scores across all four

pillars are assigned an overall score (the average of the pillar

scores).

“Some of the largest asset managers in the world have this year

become much more active in engaging in shareholder voting on the

issue of improving diversity and even the world’s oldest private

banks have taken to the industry stage to discuss their

investment strategies around ESG,” Sang Lee, managing partner at

Aite Group, said.

William Trout, head of wealth management at Celent, said: “ESG

today has reached a tipping point, and issues related to employee

welfare, gender equality, supplier diversity and other social

concerns today vie with governance and environmental

considerations for attention. Firms must prioritise diversity and

inclusion or face tangible pressure from activists and consumers

as well as investors, particularly as stakeholder capitalism

challenges the primacy of the shareholder in corporate

decision-making.”

Findings

Globally the cultural diversity of board members has increased

from five years ago but has stalled at around 30 per cent.

Europe, the Middle East and Africa (EMEA) leads the way with the

most culturally and gender diverse boards, while at country

level, Germany is the only country that has maintained a positive

increase in the percentage of culturally diverse board

members.

Regionally, Africa is ahead of other regions with on average 34

per cent of female managers.