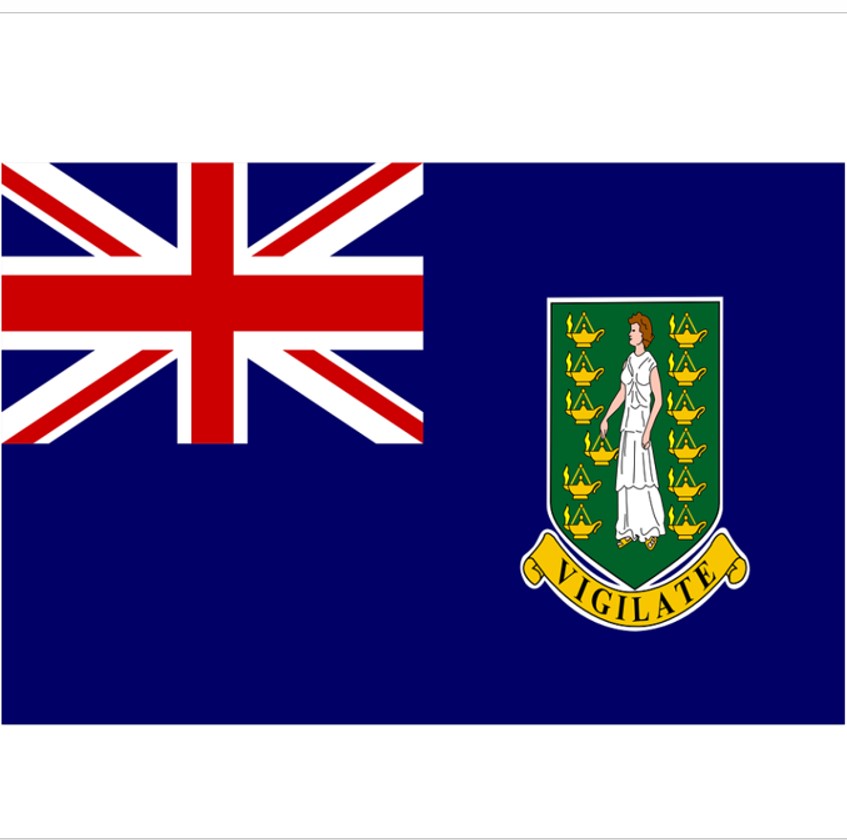

Offshore

British Virgin Islands Spells Out Contribution To Global Growth, Jobs

International financial centres, aka offshore centres, have not had an easy ride in the court of public opinion in recent decades. The British Virgin Islands intends to change the narrative, and has written a new report spelling out what it brings to the global economy.

The British Virgin Islands is pushing the case for offshore

jurisdictions in a new report, arguing that these hubs contribute

to global prosperity and ease frictions at a time when

globalisation has in some ways stalled.

A report from BVI

Finance says that the jurisdiction enables an estimated $1.4

trillion in cross-border trade and investment. There are more

than 375,000 active BVI Business Companies, roughly 57 per cent

originating in Asia and 16 per cent from Europe and North

America. Investment mediated by BVI Business Companies supports

around 2.3 million jobs globally and generates an extra $14

billion each year in taxes for governments worldwide, the report

said.

In the UK, BVI companies hold an estimated $153 billion in

assets, with 134,000 jobs created by investment mediated through

the BVI and $3.5 billion of tax revenues generated for the UK

government.

The report adds to debate on whether these international

financial centres add value to the world economy beyond what

would have existed anyway, or whether they simply divert flows

from “onshore” locations and encourage tax avoidance. Even before

the 2008 financial crash, major industrialised countries – under

the umbrella of the Organisation for Economic Co-operation and

Development – have sought to squeeze the “offshore” world,

forcing it to be more transparent. The crisis of 2008 ratcheted

up rhetoric, leading to countries such as the UK calling for

registers of beneficial ownership of companies and trusts in

places such as the BVI (the jurisdiction is a British Overseas

Territory, as is the Cayman Islands, for example.)

However, as in

the case of Jersey (a UK Crown Dependency), offshore centres

are fighting back, arguing that they are more, not less,

important in a more unstable world, and as protectionist and

other pressures mount. These hubs arose after the Second World

War when exchange controls, tariffs and high tax rates on

personal income and wealth encouraged people to seek alternative

options [for safeguarding investments]. In the subsequent years,

they’ve build clusters of expertise, retaining business long

after the original reasons for their existence had faded.

“With this research, we can continue to break down some of the

myths and educate more people on the true role the BVI plays as a

respected and valued international financial and business centre

and a key intermediary in the global economy,” Elise Donovan,

CEO, BVI Finance, said. “Whatever form the next evolution of

globalisation takes, international financial centres like the BVI

will remain vital cogs in boosting the global economy by

facilitating investment and enabling a more efficient global

marketplace.”

The Beyond Globalisation report identifies three

scenarios for the future of globalisation and the opportunities

for the BVI. In the first scenario – “Weaker internationalism” –

pre-pandemic globalisation trends continue, albeit more slowly

and with plenty of political obstacles to navigate. In “the bloc

economy,” economic and regulatory integration between

countries will continue within geopolitical blocs, but these

different groups will diverge. Lastly, “new economic nationalism”

is a partial reversal of globalisation with increased

protectionism, less porous borders and more erratic politics.

Mark Pragnell, director, Pragmatix Advisory, and author of the

report, said: “Looking into an uncertain future and beyond

the globalisation of recent decades, there are many different

scenarios for geopolitics and economics, but the need will remain

for expert, neutral and innovative centres, like the British

Virgin Islands, to support cross-border trade, investment and

mobility.”

The total size of all offshore assets in 2019 stood at €10

trillion ($11.3 trillion), based on 84 countries passing each

other information under automatic exchange agreements, figures

from the OECD in 2020 showed.

Pressures on IFCs to behave

have not gone away, although it should be noted that worries

about intra-government data exchange haven’t faded either, given

factors such as cybersecurity attacks on government revenue

departments.

Punching above its weight

In later comments to this publication, Pragnell mused on the

significance of the report.

“For me, what’s really striking [from the study] is the extent to which the BVI is as a jurisdiction is robust, and sustainable from a financial, economic and social perspective. In a global context, the BVI is punching well above its weight,” he said.

“London spends nothing on the BVI, and yet London benefits greatly from having access to the BVI’s market and its important legal vehicles," Pragnell continued.

Even though globalisation might, in certain terms, be decelerating or even going into reverse, there are still strong global trends. “In these circumstances, places such as the BVI that allow one to identify what they own and with a strong services industry, will become even more important," he said. “The gains from trade and international mobility are the same they have always been.”