Asset Management

ETFs: A Continuous Catalyst For UK Wealth Management Growth

This author argues that potential for ETF growth and variety continues to be considerable. While not without controversies at times, the rise of exchange-traded funds has been undeniably rapid.

The following article is from Miriam Breen (pictured), who is

head of exchange-traded fund and index solutions at BNP

Paribas Asset Management in the UK and Ireland.

ETFs have surged strongly in the past two decades, fuelled by

forces such as disenchantment at times with traditional active

fund management and a desire for low-cost market exposure;

changing models of wealth management and fee structures, and

more. The expansion of ETFs to cover all manner of markets has

brought its share of innovation.

The sector can be controversial. For example, ETFs arguably

increase the distance of end investors from the firms they are

ultimately holding, which blunts shareholder engagement. It has

also been noted that the sheer volume of the ETF market can

affect underlying prices of companies’ stocks. There could be

other risks. The Economist Intelligence Unit once stated that the

rise of passive investing, such as via ETFs, makes investors more

vulnerable to system-wide crashes, especially after a boom period

wherein large-cap stocks are overvalued. (See an article about

the rise of “passive”

investing.)

All that said, the ETF market is now relatively mature and looks

as though it is here to stay. Breen sets out the case for growth,

and the editors here are pleased to share these insights and

invite readers to respond. The usual editorial disclaimers

operate. Please engage with this and other topics and email

tom.burroughes@wealthbriefing.com and

amanda.cheesley@clearviewpublishing.com.

Exchange-Traded Funds (ETFs) have transformed the global investment landscape since their debut in the 1990s. Europe, including the UK, has risen to become the second-largest ETF market, accounting for 16 per cent of global assets under management (AuM) in 2023. As we close out 2024, ETFs in Europe are poised to surpass £1.67 trillion in AuM, up from £917 billion ($1.128 trillion) in 2022 – a testament to their enduring appeal.

Why Are ETFs so popular?

ETFs have reshaped how investors approach portfolio construction,

driven by three trends:

-- Retail momentum: The post-Covid era has seen UK

retail investors flock to ETFs, drawn by their simplicity and

accessibility. In 2023, the number of UK investors holding ETFs

surged 57 per cent to 1.6 million, with an estimated 1.3 million

new entrants expected in the next year;

-- Regulatory tailwinds: Increased regulatory

scrutiny, particularly over fees and transparency (e.g., Value

for Money rules), has reinforced the cost-efficient appeal of

ETFs for both advisors and investors; and

-- Flexibility and liquidity: ETFs offer wealth managers

unparalleled ease of use, with their versatility proving

invaluable in constructing diverse, adaptive portfolios.

These factors position ETFs as a key growth engine for wealth

managers. ETFs are now a cornerstone of retail products

particularly in the UK, with 1.6 million UK investors holding

ETFs – rising by 57 per cent since 2022. With a 1.3 million

first-time ETF investors predicted in the UK over the next 12

months, the future is bright for continued growth in this area.

ESG ETFs: Evolving with the times

ETFs have also embraced innovation, particularly in the realm of

Environmental, Social, and Governance criteria. The desire for

ESG integration continues to be both a regulatory requirement and

an investor priority. There is also evidence of evolving

preferences such as:

-- Some investors gravitate towards ESG-labelled funds;

-- Others prefer portfolios aligned with the Sustainability

Disclosure Requirements (SDR) and Sustainable Finance Disclosure

Regulation (SFDR); and

-- A third group seeks thematic or regional tilts, often

motivated by risk mitigation and performance potential.

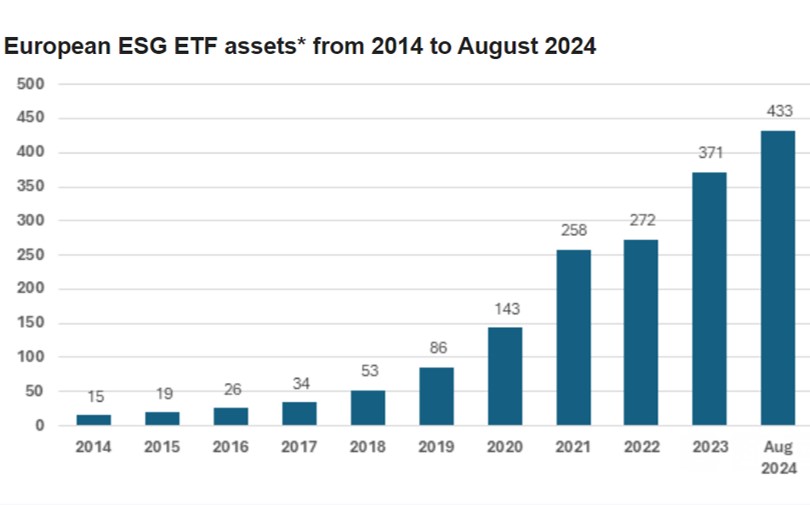

The rise of ESG ETFs is continuing to reshape portfolios across

Europe. Since 2014, ESG-focused assets have surged, driven by

tailored approaches that cater to diverse sustainability

objectives.

European ESG ETF assets* from 2014 to August 2024

The four families of ESG ETFs

We notice four distinct ESG approaches shaping demand in the

market:

-- Limited tracking error: These ETFs balance ESG

integration with minimal deviation from traditional indices,

ideal for SFDR-aligned strategies;

-- Paris Agreement alignment: Designed to meet

stringent decarbonisation targets, these ETFs are selective,

excluding lower-rated ESG companies and aiming for a 50 per cent

cut in carbon emissions versus standard indices;

-- Active ESG strategies: Offering greater flexibility,

these ETFs respond dynamically to regulatory changes and investor

preferences while maintaining a link to major benchmarks;

and

-- Thematic funds: Themes such as low-carbon economies,

biodiversity, and social priorities such as education and

food security are gaining traction, reflecting broader trends in

sustainable investing.

ETFs and the UK wealth manager

Looking ahead to 2025, demand for ETFs is poised to accelerate

particularly for active ETFs where the growth in Europe is now

sitting at about £45 billion with fund selectors increasingly

looking for new opportunities to introduce them to portfolios.

Digital savings platforms and ESG-driven mandates (e.g., SDR and

SFDR 8 or 9 classifications) are expected to play a pivotal role

in active ETF’s, offering investors robust solutions for

sustainable wealth creation.

A resilient future

ETFs, particularly ESG offerings, represent the future of passive

investing. For wealth managers, they provide a unique combination

of simplicity, liquidity, cost-efficiency, and transparency – key

qualities that resonate with clients seeking to align financial

goals with ethical values.

As innovation in this space continues, ETFs will remain a vital

tool in delivering sustainable, long-term returns for investors

and a powerful growth driver for the UK wealth management

industry.

The active ETF revolution

While passive ETFs dominate, active ETFs are emerging as a

powerful growth segment, particularly in Europe, where AuM has

reached £45 billion. Fund selectors are increasingly integrating

active strategies, driven by demand for ESG-aligned mandates

(e.g., SFDR Article 8 and 9 classifications) and digital savings

platforms.

The future of ETFs in UK wealth management

For UK wealth managers, ETFs offer a compelling combination of

cost-efficiency, transparency, and simplicity. ESG ETFs align

with clients’ growing desire to pair financial goals with ethical

values.

As innovation continues, ETFs are set to remain a cornerstone of

portfolio strategies, driving sustainable, long-term growth

across Europe’s wealth management industry. Wealth managers who

embrace this momentum stand to lead in delivering meaningful,

value-driven outcomes for their clients.

About the author:

Miriam Breen joined BNPP AM after over a decade at Legal & General Investment Management, where she most recently served as key account manager, serving clients in the UK wholesale and retail markets. She was also head of investment sales. Breen holds a BSc in economics and mathematical sciences, econometrics and quantitative economics from the University of Limerick. Breen is also completing her Investment Management Certificate (IMC).