Investment Strategies

Family Offices Boosted Equity, Fixed Income Exposures, Unfazed By Rates, Geopolitics – Citi Private Bank

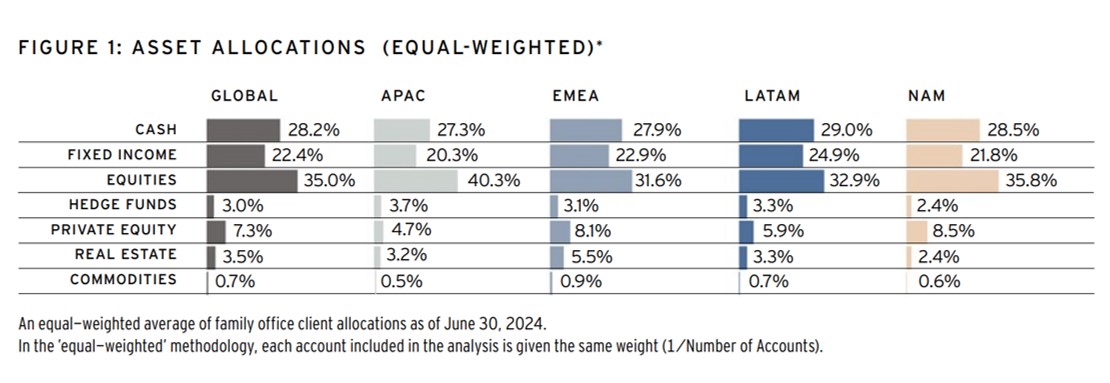

The private banking arm of Citigroup publishes its regular temperature check on what family offices around the world are doing in asset allocation.

Despite a further delay in US interest rate cuts and greater

geopolitical uncertainty, many family offices raised their

allocations to fixed income and equities in the second quarter of

2024, while further trimming their cash holdings, a survey by

Citi Private

Bank, issued late last week, showed.

Within the equities category, family offices tilted towards

developed countries’ large-cap stocks. As regions apart from

North America saw cuts in allocation to small and mid-cap stocks,

exposure to emerging markets equities was down or or flat.

Within fixed income sub-asset classes, flows were mixed across

all four regions with no clear preference. Allocations to hedge

funds rose, while activity in the commodities space was muted,

the US private banking group said.

Data was taken from more than 1,200 single family office clients

globally.

“Many risk assets rallied in the second quarter of 2024,

particularly equities. This followed our family office clients’

broad-based additions to equity holdings in the first three

months of the year. By contrast, they were more ambivalent about

fixed income, which has since done somewhat worse,” Hannes

Hofmann, head of the global family offices group, and Shu Zhang,

head of the global investment lab, at Citi PB, said in a preamble

to the report.

The report comes at a time when, as demonstrated two weeks ago

when global equity markets tumbled amid

worries about stuttering US economic growth, there are concerns

whether gains to equities so far this year could run out of

steam.

“Equities saw increased allocations in three of four regions on

an equal-weighted view. For family offices with large portfolios

at Citi Private Bank, allocations rose in every region,” the

report said.

Hedge fund allocations went up in every region bar Latin America

(equal-weighted basis), while the trend was mixed for family

offices with larger portfolios at Citi Private Bank. Private

equity saw significantly increased allocations in two regions,

with minor retreats in two other regions (equal-weighted basis).

There was no clear trend in real estate or commodities between

regions,” it continued. “Allocations were flat to positive in all

regions bar Latin America on both an equal- and capital-weighted

basis. Preferences for fixed income sub-asset classes were mixed

across regions.”

Source: Citi Private Bank