Compliance

SEC Turns Spotlight On RIAs' Outsourcing

The regulator wants to force Registered Investment Advisors to ensure all outsourced functions meet minimum due diligence requirements, and has warned of risks, including conflicts of interest, unless changes are made. Outsourcing has been a strong trend in wealth management.

The Securities

and Exchange Commission has drawn

political heat for its busy rulemaking and agenda but appears

in no mood to slow down. One of the regulator’s latest moves is

to propose that RIAs cannot outsource certain services and

functions without carrying out due diligence, and monitoring

service providers.

The SEC said it proposed a new rule under the Investment Advisers

Act of 1940 to ban RIAs from outsourcing certain services or

functions without first “meeting minimum requirements”.

“There is a risk that clients could be significantly harmed…when

an advisor outsources to a service provider a function that is

necessary for the provision of advisory services without

appropriate adviser oversight,” the SEC said in a

232-page document (ref 17 CFR Parts 275 and 279).

With many multi-family offices structured as RIAs and regulated

by the SEC (in contrast to single-family offices), the change

will impact a part of the family offices sector along with

advisors more generally.

“The risk is in addition to any risks that would exist from the

advisor providing these functions and should be managed. For

example, a significant disruption or interruption to an advisor’s

outsourced services could affect an advisor’s ability to provide

its services to its clients,” it said.

“Outsourcing a service also presents a conflict of interest

between an advisor providing a sufficient amount of oversight

versus the costs of providing that oversight or the cost of the

advisor providing the function itself. Poor oversight could lead

to financial losses for the advisor’s clients, including through

market losses and as a result of increased transaction costs or

the loss of investment opportunities,” the regulator said.

This news service regularly covers stories of how breakaway teams

of brokers and bankers quit to form independent RIAs, and have to

outsource many of the functions their old employers would have

provided. A major decision is what to outsource and what to do

in-house. As compliance costs have risen, along with client

demands, the attractions of outsourcing have increased. The same

dynamic applies to family offices, trusts and other entities.

The SEC said in its consultation paper that as advisors seek to

meet increasingly complex clients demands and access to new asset

classes, they are battling to do this efficiently. The scale of

the sector is now vast: the SEC estimates that regulatory assets

under management (“RAUM”) have increased from $47 trillion to

$128 trillion over the past 10 years; while RAUM managed for

non-high net worth advisory clients have increased from

approximately $3.7 trillion to approximately $7 trillion.

“Many advisors are adapting to the changes discussed above by

engaging service providers to perform certain functions in

In some cases, service providers may support the investment

adviser’s advisory services and processes. Supporting functions

may include, for example, investment research and data analytics,

trading and risk management, and compliance,” the SEC noted.

The SEC warned that outsourcing has the “potential to defraud,

mislead or deceive clients”. It said outsourcing necessary

advisory functions could have a “material negative impact on

clients, such as: inaccurate pricing and performance information

that advisory clients rely on to make decisions about hiring and

retaining the advisor and that advisors rely on to calculate

advisory fees; compliance gaps that enable fraudulent, deceptive

or manipulative activity by employees and agents of such service

providers to occur or continue unaddressed; or poor operational

management or risk measurement that leads to client losses.”

The SEC said a service provider’s major technical difficulties

could prevent an advisor from executing an investment strategy or

accessing an account. Sensitive client information and data could

be lost and damage clients, or client holdings or trade order

information could be negligently maintained by a service provider

and misused by the service provider’s employees or other market

participants in trading ahead or front-running

activities.

Orion Advisor Solutions, a firm working with RIAs over outsourced

functions, commented on the SEC move.

“Orion is reviewing the SEC proposal in detail so we can best

support our advisor clients as they work to understand the rule.

We will continue to review the proposed rule and monitor its

progression as it advances through the process,” Kylee Beach,

General Counsel, Orion Advisor Solutions, said.

Orion encourages all fiduciary advisors to perform appropriate

due diligence on their service providers. Our perspective is that

outsourced wealthtech can help advisors focus on their clients’

needs and fulfill their fiduciary responsibilities by maximizing

their time and leveraging technology to help ensure confidence in

the decisions they are making and in the services they are

providing to their clients.

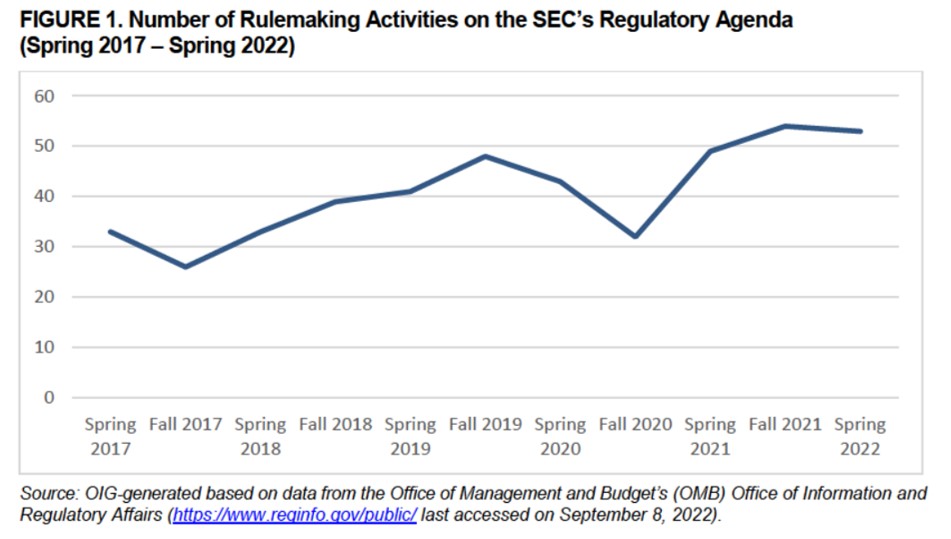

The SEC, under chairman Gary Gensler, has been chided for its

surge of new rules and initiatives, which are reportedly said to

be imposing heavy burdens on staff and causing increased staff

turnover. The SEC Office of Inspector General noted that the

volume of rulemakings on the SEC agenda increased by nearly

two-thirds between spring 2017 and 2022. Gensler is arguably

moving fast to get new rules on the books ahead of the November

mid-term elections, particularly if Democrats lose control of

Congress, frustrating his agenda.

Proposed rule

The SEC said the proposed rule would require advisors to “conduct

due diligence prior to engaging a service provider to perform

certain services or functions. It would further require advisors

to periodically monitor the performance and reassess the

retention of the service provider in accordance with due

diligence requirements to reasonably determine that it is

appropriate to continue to outsource those services or functions

to that service provider.”

“We also are proposing corresponding amendments to the investment

advisor registration form to collect census-type information

about the service providers defined in the proposed rule. In

addition, we are proposing related amendments to the Advisers Act

books and records rule, including a new provision requiring

advisers that rely on a third party to make and/or keep books and

records to conduct due diligence and monitoring of that third

party and obtain certain reasonable assurances that the third

party will meet certain standards,” it said.