Technology

Technology, Media And Telecoms Investing - Family Office Primer

The author of this article tracks common themes in TMT transactions and talks about how family offices should think and engage in this investment area. TMT has, of course, been put under the spotlight because of the pandemic.

While there can be setbacks – share prices of Big Techs were slammed last Thursday – the overall technology, media and telecoms sector has waxed of late, enabled by the huge disruption to traditional work patterns due to the pandemic, but also driven by longer-term trends. And as this news service knows, among the investors keen to stay on board the rising trend are family offices. A UK-based law firm, McCarthy Denning, works with organisations such as family offices - among others - and one of its senior figures explains the state of the terrain.

Guy Avshalom, head of TMT at the firm, is the author of this piece. The editors are pleased to share this content and welcome replies from readers. The usual editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

In the past three decades, the TMT (Technology, Media and

Telecommunications) sector has achieved an unprecedented increase

in value and market cap. The personal computer and associated

software, followed by the internet and digital technologies, have

revolutionised the human experience and changed the way we do

business. Advances in computing speed, bandwidth communications

and data storage have contributed to the explosion of the digital

economy serviced by TMT businesses. Nowadays, the opportunities

that TMT businesses are seeking to exploit only expand with the

development of new technologies.

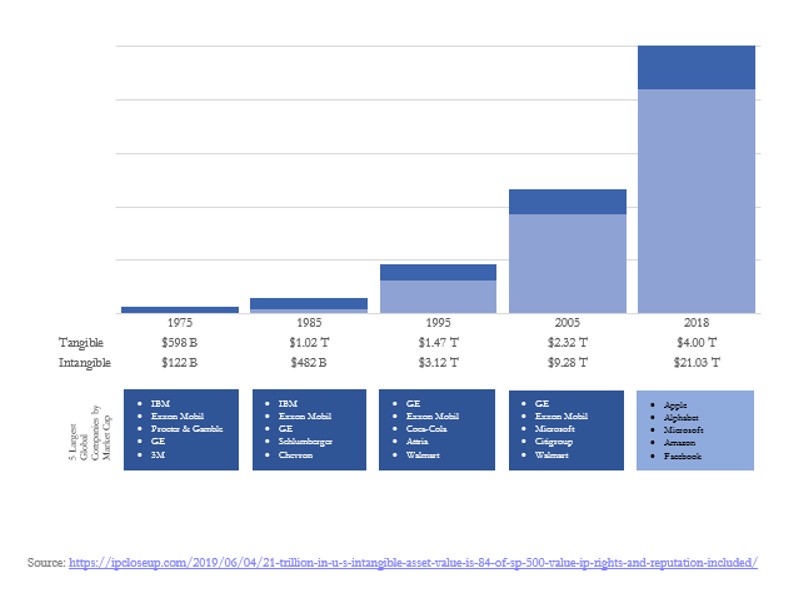

The outbreak of the COVID-19 epidemic with its global consequences ranging from lockdowns to social distancing, and remote working has accelerated the need for IP based products and services. COVID-19 accelerated a decade of normal digital evolution and condensed it into a few months, the consequences of which cannot be fully assessed at this stage. However, one thing is certain; intangible assets are going to form an even bigger part of the economy and companies’ balance sheets.

Intangible assets and, in particular, IP-based assets are a core part of the TMT business. Some TMT companies have very few real assets, but their IP is worth billions. Apple is the most notable example.

In the past 20 years, we have worked with family offices' investors and TMT companies at all stages, to structure, negotiate and deliver various TMT cross-border M&A transactions.

There are various themes that are common to TMT transactions - eight are detailed below:

1. Diversification - Investor side. It is paramount that any given TMT strategy will be carried out as a portfolio approach. I have only seen a few solo (non-portfolio) investments and they were all associated with a clear, identifiable synergy between the family office’s existing operations and the TMT investee.

2. Need for further capital. With very few exceptions, in

all early-stage (seed, first, second rounds) the investors will

be asked to continue funding the companies throughout further

finance rounds.

Failure to participate will usually mean dilution. Investors and

family offices should take as given further financing beyond

their initial cash deployment. We encourage clients to raise the

issue of potential further financing rounds as soon as possible

during the negotiations process. This goes beyond the forecast

P&L and other financial projection made by management. This

achieves a few advantages from the investors' point of view:

a) Create a better and more realistic framework

for anti-dilution provision as investors are thinking one or few

steps ahead of the applicable investment round;

b) It provides an overall better risk

perspective to the financing round in discussions; and

c) It assists investors in further assessing

management capabilities of running their business and forecasting

their performance.

Over the years we have seen various companies in the media and tech sectors which required continued investment to build up their IP assets base. We have seen investors investing in media companies expecting stable cash returns post-investment. This expectation is prevalent in more mature companies. We have seen media investors bitterly disappointed to learn that they are expected to continuously fund the business. Eventually, the business was sold at a loss as the investor was not willing to continue sinking money into the business.

3. Generally, investment in early-stage tech companies requires investors to become a minority shareholder or contemplate becoming a minority shareholder further down the line. Investors that are used to holding majority stakes and control must change their thinking. This issue closely ties into the portfolio investment I mentioned before. Regardless of whether cash is available for a particular investor, regularly investors will want, or be obliged, to become a minority shareholder due to tax incentives, for strategic or tactical reasons. The bottom line is that the investors must learn and adapt to think as a minority shareholder. This often means assessing their co-investors’ intentions, track record and past performance as part and parcel of their investment decision.

4. In many cases, investors are interested in knowing who is investing alongside them. This is only natural as the shareholders will need to cooperate in order to maximise the chance of bringing the company to the desired exit. I have seen a few cases in which disagreements between the shareholders significantly compromised the company performance. In one case, shareholders, who were offered a healthy exit, disagreed on whether to keep rolling the dice - hoping for a bigger exit - or to take a buyout offer and exit via a private sale. They decided to continue rolling the dice, which meant further dilution for non-financiers’ shareholders. In this case, there was a mismatch between the financial abilities of the shareholders and their appetite for risk.

5. The controversial aspects that come back in many negotiations can be covered by the two banners below:

a) Board composition, issues of control and veto

powers between shareholders;

b) Discounts and benefits/anti-dilution provisions on

further investments for investors and management alike; and

c) However, there is an underlying principle we have

seen in many transactions: “cash is king”. Following financing

rounds, those investors who can put in the cash will have the say

and will be able to change the terms of pre-agreed protections.

The more the investee needs further funding the more say,

influence, power and gains the funders of the next round will be

able to obtain in the investee and vis-à-vis their fellow

non-funding shareholders.

6. Management commitment is paramount. This is true for all TMT businesses but has particular importance in early-stage tech companies that seek risk capital. Investors must identify the key individuals or teams that are cardinal for business success. In some cases, the answer may not be straightforward, in particular, when the founder(s) are lacking the technological knowledge and they sign up a technology team to develop certain IP. Issues of remuneration, incentives and management dilution must be addressed upfront. We have seen cases when management lost interest in the business when their shareholdings were overly diluted.

7. Many family offices shy away from TMT investments due to the intangible nature associated with this sector. Generally speaking, it is harder to value and more abstract by definition. I have seen family offices overcome this concern by investing in the TMT sector associated with their founders' expertise. For example, a family office that made its money in banking will gravitate towards fintech investment. Insurance-based family office seeks insure-tech companies. Media family offices will naturally gravitas towards combinations of tech and media businesses. We have seen the founder and principals of these family offices harness their own personal experience in their respective business fields to identify and invest in companies positioned and operating in their natural business comfort zone.

8. A family office can take advantage of various tax incentives depending on the applicable jurisdiction. Tax considerations are part and parcel of all investment and, in particular, TMT. The flexible nature of IP assets makes an investment in TMT tax-efficient and requires diligent investors to conduct their TMT investment in a tax-efficient way.

Lastly, I would encourage family offices and their advisors to look closely at TMT investment in all stages. Often, it is perceived that tech investments only mean seed or early-stage funding. That is far from the reality. The TMT sector can offer investment opportunities of all kinds of securities ranging from private/public equity to debt and Mezz to convertibles, factoring and other off-balance sheet structures. Post COVID-19 when valuations of the biggest tech stocks in the S&P 500 achieve record highs, it is clear that TMT businesses will lead the economy in future. With a simple and methodical approach, family offices and investors alike can reap the benefit of this exciting leading sector.

TMT companies’ common characteristics:

1. Balance sheets highly reliable on intangible assets of all ranges of IP, trademarks, copyright, design rights, patents goodwill etc;

2. Investment in research and development (R&D). Generally speaking, in order to develop their products, TMT businesses take the risks and invest in new technologies, products, media products and so on. This is an innovative sector that is highly dependent on creative talent; and

3. Generally, TMT businesses are international operations, and their products have a multi-jurisdictional appeal. The core products of the business have a strong IP characteristic. In fact, it is the new IP developed or acquired by these businesses that give them the edge over their competitors.