Investment Strategies

After Post-Tariff Market Rout, Let's Talk About Behavioural Finance

There are many conversation points stemming from the large market selloffs that occurred in the US and rest of the world after Donald Trump announced a sweeping set of tariffs. One theme is investor behaviour itself, and how understanding this can reduce potential for mistakes.

Unsurprisingly, considering the $6 trillion-plus loss in value of

US stocks between 2 to 4 April and the volatility that has

continued since, investors are on edge. This is another occasion

to consider the insights of behavioural finance.

The term “behavioural finance,” a topic that was relatively

obscure within mainstream finance two decades ago, has become

more of a talking point. The term applies to understanding, for

example, how people mistake portfolio gains for pure skill rather

than also accept the role of chance or treat losses more

emotionally than they do with gains and follow crowd

behaviour.

These biases can lure investors into buying stocks when they are

expensive because of the “herd” mentality, or a sort of “FOMO”

effect – fear of missing out. And it can induce unwarranted

despair, leading people to selling assets in what, with

hindsight, was the bottom of the market. (A problem with all this

is that humans act based on necessarily imperfect information; we

are not omniscient, and no-one wants to be in the position of

being right, with hindsight, but still broke.)

A bank that has blazed a trail on behavioural finance is

Barclays.

Alexander Joshi, head of behavioural finance at Barclays Private

Bank, said it is crucial for bankers and advisors to

understand their clients’ mindset during periods of market

volatility, while also being aware of their own behavioural

biases.

“Recent market volatility is understandably unsettling for many

investors. Periods of uncertainty often heighten caution, leading

some clients to consider shying away from risk. As such,

understanding investor psychology becomes not just helpful, but

essential,” Joshi said in comments emailed to this

publication.

“Cautious investors may be susceptible to confirmation bias,

subconsciously seeking evidence to support their belief that

investing is too risky at present. Inevitably, they will find it.

At the same time, recency bias may cause investors to give

disproportionate weight to recent market events when

decision-making, shifting their focus away from longer-term

objectives. In bear markets, such behavioural biases tend to get

magnified; risks loom larger, and the worst-case scenarios

dominate attention. Yet often, the perception of the probability

of these outcomes is distorted,” he said.

(“Recency bias” refers to a cognitive bias that favours recent

events over historic ones.)

“Helping clients step back, revisit their goals, and maintain

perspective allows them to avoid reactive decisions and remain

aligned with their long-term plans. Some clients respond well to

data, while others need reassurance and empathetic dialogue.

Recognising individual differences in risk tolerance and

emotional response enables us to support clients more

effectively,” Joshi continued.

Advisors have their own biases, he noted.

“Our mindset also has a part to play here, too. As trusted

advisors, we influence how clients feel about markets, not just

what they know. If we sound rushed, anxious, or reactive, it’s

contagious. If we’re composed, balanced, and confident, it

creates stability. That’s why we must remain mindful of how

current turbulence affects not just our clients but our own

psychology too,” Joshi said.

Experience matters

The behavioural angle comes up when Miranda Seath, director of

market insights at the Investment

Association, the UK-based organisation, commented on the

aftermath of President Donald Trump’s tariffs announcement of 2

April.

In particular, Seath referred to how experience of volatility –

or the lack of such hard-earned experience – is an important

factor to track.

“If we look back at how investors and markets reacted to the most

significant market events in recent history – the 2008 Global

Financial Crisis and the 2020 Covid-19 pandemic – today’s

investors are operating against a very different backdrop,” Seath

said in a note.

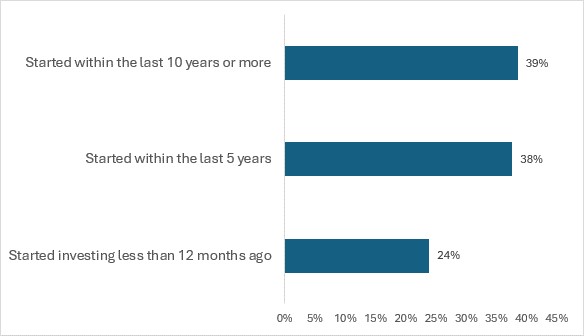

“The time people have spent in the market will also influence

behaviours. IA and Opinium research from March 2025 found that

over a third of investors (38 per cent) started within the last

five years, meaning they likely have some experience of

volatility from both the pandemic and the gilt market crisis of

2022,” Seath said. “These investors have already been through a

significant market correction and whilst they saw the value of

their investments fall, they also experienced the

rebound.

“Others may be capitalising on the situation and 'buying the

dip' – upping their investments when market prices are low.

We saw this in IA data in March 2020 during the pandemic –

interestingly investors buying in favoured the UK, a fleeting

example of home bias. However, nearly a quarter of investors (24

per cent) started investing in the last year, according to our

latest research.

“These investors will not necessarily have experience of market

volatility. With many investors making decisions at the start of

the tax year, good communication and support will be crucial for

this group. When markets are turbulent, it is important to

maintain a long-term perspective and carefully consider any

investment decisions. Diversification across asset classes and

geographies can also help manage risk and market downturns. While

the uncertainty is set to continue in the near-term, staying

invested may be the best strategy,” Seath said.

Investment habits by time

Notes on chart: In 2025, the IA again partnered with Opinium

to conduct a survey about saving and investing habits in the run

up to the 2024/2025 ISA season. The survey fieldwork took place

between the 28 February 2025 and the 5 March 2025. We surveyed

three groups: • 1000 UK investors • 1000 UK Cash ISA or Junior

ISA holders • 2000 UK adults (18+) where the respondents were

weighted to be nationally representative of the UK adult

population. Source: IA.