Wealth Strategies

DBS Sees Return Of “60/40” Asset Allocation

The Singapore-based bank sets out its views for 2023. It argues that after the market falls of last year, the stars are in alignment for a return to the 60/40 equity/bond approach to asset allocation.

As interest rates rise to curb the highest inflation rates in

four decades, traditional asset allocation concepts that were

torn up in the aftermath of the 2008 financial crash might, like

an ageing rock group, be making a comeback tour.

One traditional notion is that a 60/40 per cent split between

equities and bonds, respectively, confers a degree of upside

exposure to risk assets with a “ballast” of bonds to guard the

downside.

Over the past year, however, anyone hoping for protection in this

way was disappointed. Equities and government bonds fell in

tandem as rates rose as a result of the Russian invasion of

Ukraine, China’s zero-Covid policy and other forces hurting the

stock market.

But maybe the time is approaching when the 60/40 model will work

again, according to Hou Wey Fook, chief investment officer,

DBS Bank, in a

report examining themes for this year.

“With bond yields at above 5 per cent today and equity valuations

having been reverted, we believe the window is now open to be

engaged for the long term, in a multi-asset portfolio of equities

and bonds,” Hou said. “What is critical is for investors to build

resilient portfolios that comprise securities of high-quality

companies that demonstrate traits of being income generators,

growth enhancers, and risk diversifiers.”

Hou expects risks of recession to slow the pace of further rate

rises at the US Federal Reserve and other central banks. He

predicts that rates will peak at around 5 per cent; inflation

will slow down but not to the degree that will make the US Fed,

for example, cut rates.

“For investors who bemoaned the lack of `value opportunities’ in

risk assets previously, the time has come. As painful as 2022’s

sell down has been, it has also surfaced fresh opportunities for

investors to construct a traditional 60/40 portfolio with a great

starting point,” Hou said.

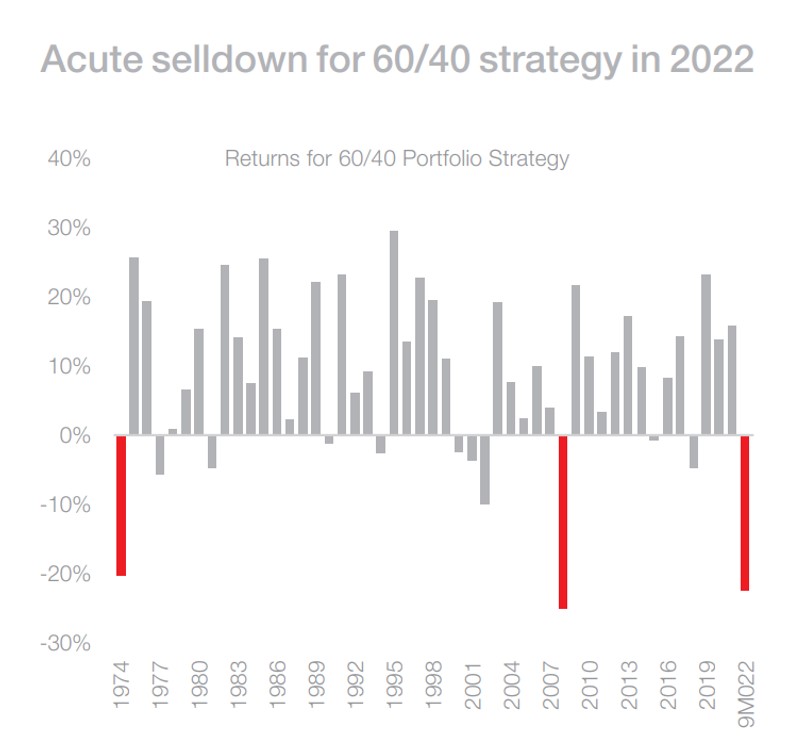

DBS looked at the US S&P 500 Index as proxy for equities and

the Bloomberg US Corporate Bond Index for bonds, arguing that on

data stretching back to 1974, there is an attractive risk-reward

for a traditional 60/40 portfolio strategy now.

Source: DBS, Bloomberg

Is there a shift coming?

Some wealth management investment chiefs think clients must

prepare for a shift when it appears that the rate-rise cycle has

topped out. For example, UBS global wealth management’s chief

investment officer, Mark Haefele, has argued that rising bond

yields make fixed income assets more attractive as a source of

income.

He also thinks that this year is a good one in which to deploy

more capital into private markets, because investing in vintages

after public markets peak has historically generated outsize

returns. In the final month of 2022, meanwhile, data on the

actual buying and selling behaviour of investors showed that they

took risk off the table.

DBS’s Hou has upgraded bonds to “overweight,” justified by

the wide bond-equity yield gap. Investment-grade credit, for

example, with yields rising above 5 per cent, gives a “blend

of income and safety,” he said.

The CIO also argues that clients should stay with “high-quality”

equities and those with plenty of protection against adverse

events, known in the Warren Buffett sense as having a wide

“moat.”