Alt Investments

Families Should Pile Into Venture Capital - Study

A report claims that the long-term benefits of investing in venture capital are so great that families, for example, should consider dramatic increases in the share of their wealth placed into the asset class.

There has been a big influx into venture capital as an asset

class over the past 10 years, with some top-performing

institutional investors parking as much as 15 per cent or more of

assets into VC, a study of the sector that trumpets its virtues

says.

A study of VC by Cambridge

Associates finds that institutions in the top decile for

returns had an average of 15 per cent allocation in venture – and

some higher than that, and a greater share may be appropriate for

private investors. In fact, families should consider bumping VC

up to 40 per cent of their assets if their time horizons can

accommodate it, it said.

The report comes at a time when organisations such as family

offices, foundations and endowments have been encouraged to

consider VC and other relatively illiquid asset classes. This is

because investors win a superior return compared with more

mainstream areas such as listed equities, particularly in an

environment of very low interest rates.

The asset class has matured from the highly volatile pattern of

returns seen in the dotcom frenzy of the 1990s, and changes in

the structure of how companies are financed and owned means that

potential for VC is much greater today, the report, entitled

Venture Capital Positively Disrupts Intergenerational

Investing, said.

One concern has been that there is now more than $2.0 trillion of

“dry powder” in private capital markets (private equity, private

debt, venture capital and forms of infrastructure) – a term

applying to money that is available to be deployed. Without

sufficiently profitable opportunities, the concern is that such a

large lump of money will squeeze returns. Preqin (25 September 2019)

found that venture capital assets under management doubled over

five years to 2018, reaching $856 billion as of December 2018. VC

comprises 14 per cent of the $6.06 trillion global private

capital industry.

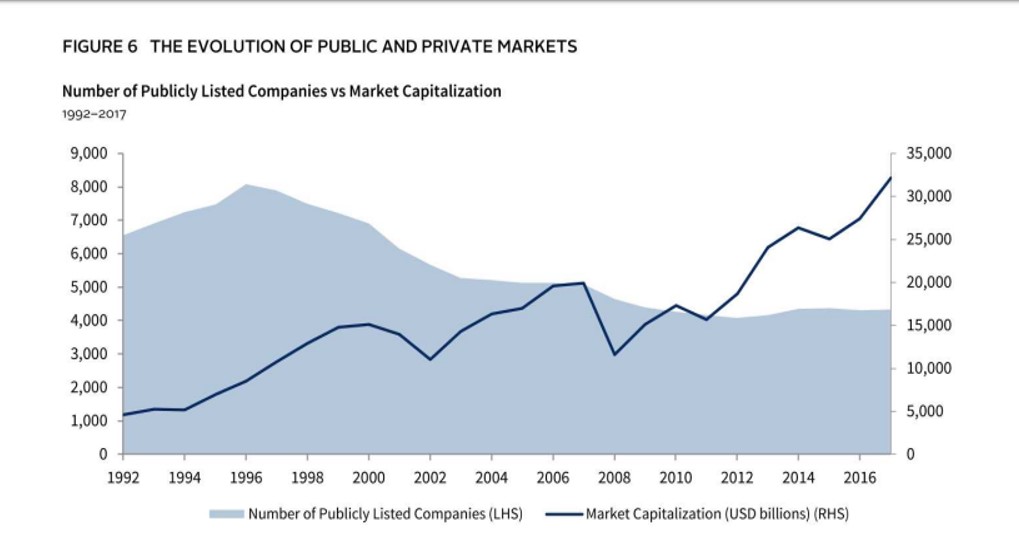

Cambridge Associates’ report argues that there is plenty of

headroom in VC because a higher proportion of businesses today

are privately held than was the case two decades ago. Over the

past 20 years, the number of publicly traded US stocks has shrunk

by almost half, to 4,336. That compares with 8,353 unrealised and

partially unrealised VC-backed companies in 2019.

Source: Cambridge Associates

“While not all these companies will survive, or prosper, many

will generate significant returns for investors,” the report

said.

“Fears of too much money being raised in the VC space are

consistently based on historical levels, rather than future

potential. When put into context, the amount of money raised in

VC represents a fraction of the market value of the industries

being disrupted by many venture-backed companies, and a fraction

of the total addressable markets of emerging business categories

being created by VC,” it said.

VC, in fact, is tiny compared with the overall investment

universe, the report said: VC at $340 billion net asset value is

less than 0.5 per cent of the $85 trillion in global equity

valuation.

The report cautioned about the media noise around “unicorns”

(firms valued at more than $1.0 billion) and some of their

associated IPO disappointments (Uber, and others). “Once aptly

named, unicorns are no longer rare and elusive,” the report

continued.

The benefits to investing in VC over the long-term when set

against listed equities are clear, Cambridge Associates said.

“Given muted return expectations for public equities over the

next 10 years, increasing allocations to VC may prove to be

beneficial. Consider the following maths: A properly constructed

VC portfolio will target a 300 per cent return over the life of

the fund (typically 10 years). By comparison, to earn a 200 per

cent return on a public stock over 10 years, the stock would need

to have an annualised return of about 7 per cent,” it said.