Investment Strategies

Get Ready For Reversal Of Open-Markets Trend Amid Ukraine Crisis, Says Saxo Bank

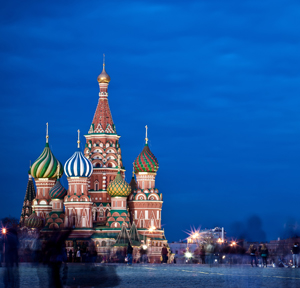

Developments in the Crimea peninsular have the capacity to be a reverse of moves towards open borders and liberal economics seen after the collapse of the Berlin Wall 25 years ago, says Saxo Bank.

As global equity markets retreat, wheat prices rise and gold

gains in the wake of Russian forces’ threat to Ukraine,

developments have the capacity to be a reverse of the move

towards open borders and liberal economics seen after the

collapse of the Berlin Wall.

That is the view of Steen Jakobsen, chief economist of Saxo Bank.

“Like in 1989, the Russian Bear is tired and we all face the risk

that the Ukraine will become a new Berlin Wall, but this time the

wall is going up not down – and let’s remind ourselves that we

will all be losers in that game. Europe needs Russia’s energy,

Russia needs European engineers and business people, but right

now we are as divided as we have been since 1989 – which is

ironic as we are at the 25th anniversary of that Berlin wall

falling,” Jakobsen said in a note.

Developments will increase market volatility, he said – and

happening at a time when emerging markets have been through a

difficult few months as the prospects grow for an end to the

period of quantitative easing by central banks.

According to Bloomberg around mid-morning in London

today, the MSCI All-Country World Index slid 0.7 per cent.

Russian stocks fell the most in four years and Ukraine’s

Eurobonds fell by the greatest extent on record. Standard &

Poor’s 500 Index futures dropped, gold prices and Brent crude oil

prices rose, and wheat futures rose by as much as 4.5 per cent at

one stage, amid worries that Western economic sanctions against

Russia’s actions could hit trade in wheat, among other

commodities.

Saxo’s Jakobsen said the latest actions by Putin’s regime are

those of an administration trying to protect its power in a

difficult economic environment.

“Russia to me is a politically, economically and strategically

cornered. I will make no big political statement on Ukraine et

al, as I think it speaks for itself, but let me remind you of

Georgia – it led to one of the biggest sell offs in history for

the Russian stock market (coinciding with the financial crisis)

and, according to several analyses this morning, has another

parallel in the form of the Olympics which also took place around

the same time,” he said.

“In 2008 Putin was out of the country attending the opening of

the Beijing Olympics; this time, Putin used the end of Sochi

games to escalate events. The point, of course, it that he has

tried to use the focus of the world’s media on the Olympics as a

way to `get away with something harsh’,” Jakobsen said.

Russia’s economy has moved from a 6-8 per cent current account

surplus pre-crisis to this or next year going into a deficit,

despite high energy prices. Growth in 2013 was less than 1.3 per

cent versus. government expected 3.0 per cent - this year will

see Russia in recession, according to my economic models, unless

a real reform takes root,” he continued.

He pointed out that the Russian central bank has adopted a

relatively tight monetary policy, coming at a time when unsecured

lending had “spiralled out of control”.

What is particularly disturbing, Jakobsen said, is that the

crisis in Ukraine and elsewhere demonstrates a lack of political

leadership. He predicts further weakness to the Russian

rouble.