Wealth Strategies

Global Investors Shun Risk, Embrace Private Markets - BlackRock

.jpg)

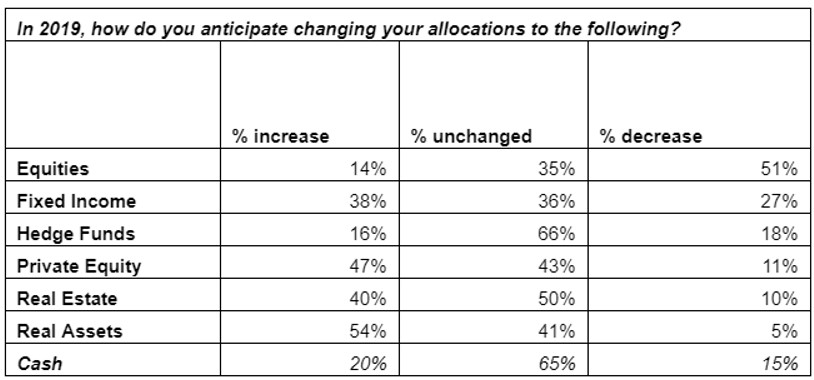

The study, drawn from more than 230 institutional clients, shows investors are retreating from the listed equity market and looking elsewhere this year.

A survey by asset management giant BlackRock of 230 of its

biggest clients, together accounting for over $7 trillion in

assets, shows just over half (51 per cent) of them want to cut

exposure to equities this year, while 47 per cent want to raise

private equity holdings, a sign of how worries about stock

markets are growing.

The world’s largest listed asset management firm also showed that

only 14 per cent of clients want to increase holdings of equities

in 2019; 38 per cent want to raise fixed income; and 40 per cent

of them want to boost real estate holdings.

Investment managers and family offices were among the

institutions covered in the study.

Some 56 per cent of clients said a possible shift in the economic

cycle is one of the most important macro risks influencing their

rebalancing and asset allocation plans.

In a continuation of a multi-year structural trend of

reallocating risk in search of uncorrelated returns, illiquid

alternatives are set to see further inflows.

The retreat from listed equities appears to be accelerating: 35

per cent of clients planned cuts in 2018 and 29 per cent did so

in 2017. This trend is most pronounced in the US and Canada,

where over two thirds (68 per cent) plan to reduce equity

allocations, followed by APAC (40 per cent), compared with just

27 per cent in Continental Europe.

“As the economic cycle turns, we believe that private markets can

help clients navigate this more challenging environment,” Edwin

Conway, global head of BlackRock’s Institutional Client Business,

said. “We have been emphasising the potential of alternatives to

boost returns and improve diversification for some time, so we’re

not surprised to see clients increasing allocations to illiquid

assets, including private credit,” he said.

Ironically, the desire to shift even more into private equity and

other non-listed sectors, at the expense of listed stocks, could

be an example of the kind of group mentality seen in markets over

the years, often seen in retrospect as a mistake. There has been

a significant rise in flow into private equity over the past few

years, driven by a desire for the illiquidity premium that this

asset class pays, contrasting with lower yields on equities.

Intended fixed income allocations have seen a rise, from 29 per

cent planning to increase allocations in 2018, up to 38 per cent

in 2019. Within fixed income, the shift to private credit

continues as over half (56 per cent) of global respondents plan

to increase their allocations with Asia-Pacific following the

trend (43 per cent).

BlackRock said survey respondents also expect to increase

allocations to other fixed income areas, such as short duration

(30 per cent), securitised assets (27 per cent) and emerging

markets (29 per cent), most likely reflecting relative value

opportunities in these asset classes.

Most institutions want to maintain or even increase their cash

levels in 2019, especially in the Asia Pacific region, where a

third (33 per cent) plan to increase their cash holdings to

protect their portfolios.

ESG

Within equity portfolios, investors are changing their focus. The

three most prominent considerations are to cut public market risk

in portfolios, which was cited by two-fifths (41 per cent), while

a third (32 per cent) want to boost allocations to alpha-seeking

strategies and a quarter (28 per cent) will focus more on

environmental, social and governance strategies and impact

investing. (“Alpha” refers to the market-beating returns achieved

by specific active strategies.)

“In a world of increased market volatility and great levels of

uncertainty, clients are reimagining what they do with their risk

assets. It’s important for clients to stay invested, with

equities continuing to have a very significant role in portfolios

and alpha seeking-strategies making particular sense in the

current climate. We’re seeing clients becoming more purposeful

about their alpha exposures going forward,” Conway said.