Alt Investments

Gold's Back On Agenda As Inflation Worries Grow - Study

Gold may not have the tech "cool" of cryptocurrencies such as bitcoin at the moment but it's been a store of value over the centuries. As inflation clouds gather, so are asset allocators looking at the yellow metal.

Concerns about inflation as governments’ massive central bank

money printing efforts, coupled with dislocations caused by the

pandemic, are encouraging institutional investors to hold the

classic hedging tool of gold, so figures show.

A survey of 477 institutional investors around the world showed

that demand for inflation-hedging tools is helping to drive

allocations to gold, a report published by the World Gold

Council, the body representing mining, trading and investment

organisations, said. The report was compiled by the research

group, Coalition Greenwich, between October 2020 and January this

year.

Recent inflation numbers have started to stoke concerns that the

sheer amount of central bank quantitative easing – as banks have

bought up government debt – is starting to make an impact.

Dislocations to some global supply chains is also held to be a

factor. In the US, for example, the consumer prices index rose at

an annual rate of 5 per cent in May, up from 4.2 per cent in

April and the highest since August 2008. For investors used to

tame consumer price numbers for the past decade, the figures are

a jolt.

Gold has in some ways taken a back seat to cryptocurrencies in

recent years as a talking point about how to protect against

inflation and government policy shifts, but gold remains an

important asset class and central bank reserves asset. The third

iteration of “Basel” rules, which set risk capital weights banks

must use, has the effect of classing physical gold – as possible

to proxies such as gold certificates or ETFs – as a zero-risk

asset. Banks holding gold proxies must set aside more reserves.

New rules came in at the end of June.

Investors around the world are responding to signs of rising

prices, injecting new volatility into global financial markets.

"For the most part, however, Western policymakers view recent

price hikes as temporary effects of an economy emerging from a

pandemic-induced slumber,” the Coalition Greenwhich report

said.

“Largely unfazed by the inflation threat, the US Federal Reserve

appears committed to maintaining both its asset purchase

programme and its low-interest-rate policy, and the Biden

administration continues to support stimulus and spending

packages that together would inject trillions of additional

dollars into a US economy that some fear is already

overheating.”

Some 45 per cent of study respondents include interest-rate

projections as one of the top three drivers of long-term

portfolio allocations. For short-term allocations, half of

institutions cite liquidity concerns as a top-three driver, and

around 40 per cent cited interest-rate projections, reflecting

concerns about both near-term market conditions and the threat of

inflation, it said.

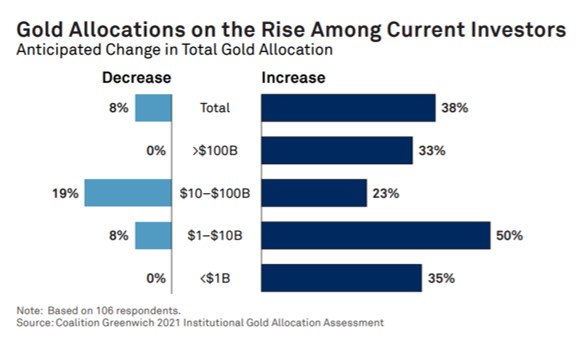

About one in five institutions have specific allocations to gold

in their portfolios. Allocations are most common among

institutions in Europe, the Middle East and Africa (29 per cent)

and among the world’s biggest institutions, or those with more

than $10 billion in assets (27 per cent). The average gold

allocation for investors who own or include gold in their policy

portfolio was 4 per cent. Almost 40 per cent of current gold

investors expect to increase their allocations in the next three

years, and about 40 per cent of institutional investors who do

not have gold exposure but have a target or have considered it,

plan to make an investment in that time frame, it said.