Alt Investments

Hedge Fund’s Mid-Year Trends, Strategies In Demand - An Overview

The US-based author of this article delivers a broadly upbeat view of the hedge fund sector and looks at the sectors and results of specific strategies.

The following article takes a tour around the strategies and

fortunes of a variety of hedge fund types, and asks what is

driving returns, and what the future holds for this sector of the

investment world. We hope the article feeds into the debate about

the continued role of hedge funds in wealth management

portfolios. The article comes from Donald A Steinbrugge, CFA,

founder and chief executive of Agecroft Partners.

His firm is based in Richmond, Virginia.

As always, of course, the editors do not necessarily endorse all

views of guest writers. Jump into the debate! Email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

The hedge fund industry is dynamic, comprising numerous

strategies that attract varying degrees of interest over time.

Demand for each strategy is impacted by many variables including

capital market valuations, expectations of economic growth,

market liquidity and risk appetite among others. Industry

professionals spend a great deal of time analyzing these

variables in order to identify which strategies they believe

offer the best opportunities for outperformance. In this paper,

we share some data and thoughts on where investors are focusing

their time and resources starting with a brief overview of

developments year to date.

2020 has been one of the most volatile years for the capital

markets over the past century. The year began with questions

looming about the sustainability of the seemingly ever-rising

equity markets.

That uncertainty accelerated dramatically at the end of the first

quarter. Equity and credit markets experienced material market

value declines in response to the expectation of a sharp economic

stall instigated by COVID-19. Generally, most hedge fund

strategies performed in line with investors’ expectations. Still,

some less liquid fixed income strategies that were not properly

hedged sustained large, unanticipated, drawdowns leading to large

redemptions. In some cases managers imposed gates and suspended

redemptions. A flight to quality by investors combined with a

disproportionate amount of time required to address fund “blow

ups” resulted in the postponement of the majority of new hedge

fund allocations.

Entering the second quarter, the response of central banks around

the world, in the form of massive monetary stimuli, drove nearly

immediate, strong recoveries across the global capital markets.

As a result, a large portion of world sovereign debt is trading

close to 0 per cent at mid-year. Concurrently, most equity

markets are trading at valuations well above their historical

averages, by the belief that monetary stimulus would result in a

quick rebound in economic activity.

As the summer comes to a close, many of the drivers of volatility

remain unchecked including the spread of COVID-19, the US trade

war with China, the US election and massive increases in global

debt. The big question is, how are investors processing these

uncertain variables and what is the impact on their investment

thinking?

One way to address this question is to ascertain which strategies

are attracting current investor interest. As of last week, nearly

300 “approved” investors are registered to participate in the

upcoming Gaining The Edge - Global Virtual

Cap intro event. In the registration process, they

completed a detailed survey about what type of strategies and

managers they are interested in meeting. Of the investors

completing the survey:

33 per cent are institutional investors(including large pensions,

endowments, and foundations);

9 per cent are advisors and OCIOs;

36 per cent comprise family offices, multi-family offices, and

high net worth individuals;

22 per cent are funds of funds.

We believe this survey contains high quality data and provides an

accurate depiction of current demand across the hedge fund

industry. This is both a function of the composition of investors

participating in these surveys, and that these preferences will

be shared with hedge fund managers as part of the meeting

scheduling process.

From the survey data, we share the following

observations:

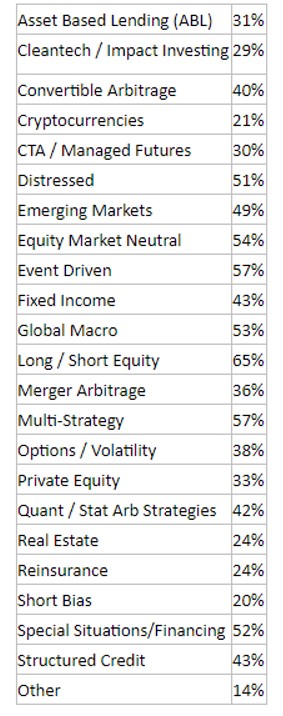

Investors were first asked to list their current strategies of

interest. Long/short equity captured 65 per cent of respondents,

the largest share among all strategies. This indicates a positive

change in investor sentiment regarding a fund manager’s ability

to generate alpha in stock selection. Long/short equity has been

losing market share for a number of years in the hedge fund

industry and this data suggests a potential reversal of that

trend.

Multi-strategy and event driven showed the second highest level

of interest at (57 per cent). This was followed closely by equity

market neutral (54 per cent), global macro (53 per cent), special

situations/specialty financing (52 per cent), distressed (51 per

cent).

The increased interest in global macro, compared with a few years

ago, indicates investor confidence that this strategy can take

advantage of the increased volatility. More importantly this

increase, along with the high level of interest in equity market

neutral strategies, further supports the trend of increasing

demand for strategies that are uncorrelated to the capital

markets. Driving this trend are a combination of reducing

portfolio tail risk and institutions shifting assets away from

low yielding fixed income to a diversified portfolio of

uncorrelated hedge fund strategies in order to enhance returns.

Other strategies that will benefit from this trend include

relative value fixed income, short term CTAs, and

reinsurance.

The interest in distressed and special situations shows an

increased willingness by investors to consider less liquid

strategies along with a blurring of the lines between hedge funds

and private equity as investors consider both structures to

access these strategies.

A few niche strategies that are beginning to gain interest

include cryptocurrencies at 21 per cent and cleantech/impact

investing at 29 per cent. Below is a full breakdown of the survey

results.

Strategies of Interest:

In addition to indicating strategies of interest, investors were

also asked to indicate the minimum fund size to which they would

consider making an allocation. Of the respondents, 41 per cent

would consider new fund launches and an additional 23 per cent

were open to funds with less than $100 million. 32 per cent of

investors said they would consider funds between $100 million and

$1 billion and only 4 per cent said they required a fund to be $1

billion or bigger. They were also asked about the minimum length

of track record with 43 per cent willing to invest with less than

a one year record and 71 per cent less than a three-year

record.

These results were somewhat surprising, considering institutional

investors represent almost one-third of those participating in

the event (and this survey). However, this data confirms other

indications that the minimum asset requirement for various

investor types has declined over time and especially in the past

several years. This may be, in part, attributable to the

significant investment large pension funds have made into

improving their internal processes. A majority have built out

their research staff and, in so doing, have increased their

confidence and comfort with investing in smaller and emerging

managers.

As we head into the fourth quarter, we anticipate an increase in

hedge fund allocations due to pent up demand from earlier in the

year. This survey should provide good guidance on the

strategies to which assets will flow.

Additionally, as most investors and managers have become

comfortable using Zoom and other virtual meeting providers, most

will adopt this technology as part of their ongoing due diligence

process. It will likely become a highly used tool to facilitate

introductory meetings. In some cases, as we have already seen,

investors may use virtual communication to facilitate their

entire due diligence process.

About the author

Steinbrugge is founder and CEO of Agecroft Partners, a hedge

fund consulting and marketing firm. He writes white papers on

trends he sees in the hedge fund industry, has spoken at

conferences and been quoted in numerous articles. Steinbrugge

also founded Gaining the Edge LLC that runs the annual Hedge Fund

Leadership Conference, the Hedge Fund Educational Webinar Series

and the Global Virtual Cap Intro Events.