New Office

INTERVIEW: Summit's CEO Lauds Cayman Islands As JV Is Announced

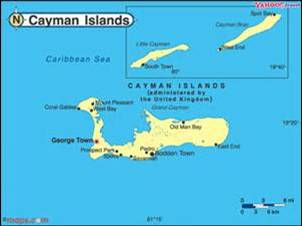

Offshore locations such as the Cayman Islands don't always receive a friendly press, but as far as a major trust company is concerned, it remains a prime location, explaining why it has recently embarked on expansion there.

Last week’s announcement by Summit Trust International to develop more business via the Cayman Islands by using a joint venture is built on admiration this firm has for the jurisdiction’s legal and financial systems, its chief executive says. And his comments appear to be supported by actions of other firms in continuing to drive forward business in this Caribbean location, suggesting that it remains an important wealth management centre despite some of the pressures that such offshore centres face.

While headquartered in Geneva, the organisation has a presence in a range of jurisdictions, such as Mauritius, and it was a logical step for Summit to move to a more durable relationship with the Caribbean financial centre, Daniel Martineau told this publication.

As reported here, the joint venture is being established by Summit Trust International with Marcus Parker, a private client lawyer and trustee. The arrangement is subject to approval by regulators. Parker was a founding partner of the boutique private client law firm New Quadrant Partners in London in 2010. He moved to the Cayman Islands at the end of 2013.

"We have had a long admiration for that jurisdiction and have

used it extensively in the past. We like the law and its

flexibility; we like the depth of its professional talent pool

and believe that its governance and judiciary are reliable. We

have had an active project to be located there for the last two

years, but only with Marcus were we convinced that we have the

right partner on the ground,” Martineau said.

“Clients from regions such as the Middle East like jurisdictions

such as the Cayman Islands and Geneva so we will continue to mine

that same vein. There is also an appetite for Cayman structures

in Asia where Cayman is considered a more robust jurisdiction

than perhaps some of the others marketed there,” he

continued.

One question this raises is about the common law system

in the Caymans and how this differs from what typically happens

in Switzerland, so how does Summit operate in different

jurisdictional systems like this?

“While Summit was founded in Switzerland, a civil law

jurisdiction, in fact we have always managed structures based on

common law, by borrowing the law of a jurisdiction like Cayman to

use as the basis for the trust. This has been effectively done in

Switzerland for decades however was validated by Switzerland

adopting the Hague Convention on Trust in 2007,” Martineau

replied.

"What is exciting about this is that we are expanding the

business model that is already working well for us in Geneva and

Mauritius; it is a model that suits clients because it is all

about cultivating high-quality relationships with director-level

professionals who are empowered and who are shareholders. We

believe that sharing equity is important to be able to attract

and retain talented people. We want to make sure we have equity

partners in every office," he said.

Summit was created in 1999 by Martineau, Stella Mitchell-Voisin

and Robin Lee Smith as Close Trustees Switzerland. The firm took

on its current name via a management buyout and the majority

stake of Close Brothers was sold to South Africa-based Sanlam

Group in 2011. Among recent developments, in 2013 Summit bought a

50 per cent stake in Sable Management Services in Mauritius,

renaming the organisation as Summit Trust Mauritius.

Cayman's appeal

While the British Overseas Territory, along with other offshore centres such as the British Virgin Islands, Jersey, Guernsey and the Isle of Man, has endured a degree of pressure in recent years from major nations seeking to clamp down on alleged tax dodgers, firms continue to hire and build business operations in the location. For example, last week, Burr Pilger Mayer, a California-based accounting and consulting firm, launched an office in the Cayman Islands to further its reach in the hedge fund and alternative investment space. Offshore law firm Ogier, meanwhile, appointed Ulrich Payne as a new partner within its expanding Cayman Islands dispute resolution team. Payne joined from the London practice of law firm Kirkland & Ellis International, where he was partner.

In April, Mitsubishi UFJ Fund Services launched Cayman Islands Trustee Services to target new and existing unit trusts in the Caribbean jurisdiction. The firm said its services add to the established fund administration offerings provided for Cayman Islands structures.

Li Ka-shing, one of the richest men in Asia and indeed the world, earlier this year stirred controversy about his interest in Hong Kong by setting out a large restructuring of his business empire, shifting its corporate base to the Cayman Islands. Li, who is the chairman of Cheung Kong (Holdings) and its subsidiary Hutchison Whampoa, with a total market value of HK$661.68 billion ($85.34 billion), explained that all of his firms’ non-property assets, such as ports, telecommunications, retail, infrastructure and energy, will be placed into a newly created company, CK Hutchison Holdings (CKH Holdings), incorporated in the Cayman Islands, media reports said. Property assets will also go into a Caymans-domiciled structure, Cheung Kong Property Holdings. It will seek a separate listing on the Hong Kong stock exchange.

There remain challenges, however. In December last year, UK and European Union proposals to create public registers of beneficial owners of businesses and trusts drew fire from politicians in the Cayman Islands.