Statistics

London's Financial Centre Recovers, Shrugs Aside Brexit – Data

The figures point to a talent shortfall rather than a surplus of financial industry people struggling to find a job in London's City and wider financial community. Fintech is a particular driver.

London’s financial industry is recovering from the pandemic and

on target to chalk up real growth this year, with 40 per cent

more jobs advertised in the fourth quarter of 2021 versus

the same period in 2019, recruiter firm Morgan McKinley said

yesterday.

More than a quarter of people surveyed (34 per cent) were looking

for new job opportunities, the organisation said. When

annualised, figures show a small change in total jobs available

between 2021 and 2019.

“The future is bright for City recruitment as the country starts

to see the light at the end of the pandemic tunnel. With many

companies getting their heads around working from home in 2021

and children back in school, we saw the sector grow beyond

pre-pandemic levels by the end of last year,” Hakan Enver,

managing director, Morgan McKinley UK, said.

The report adds to a general sense that the jobs market for

financial services – at least in certain fields – is tight,

creating a challenge for wealth managers and others to source

talent without busting their budgets. (See

a story here.)

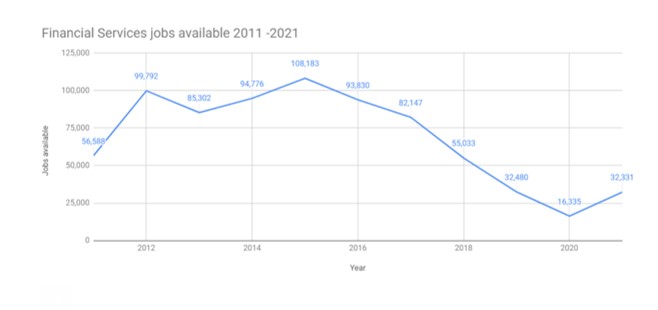

In total in 2021, there were 32,331 financial services jobs

created in London, a 118 per cent surge from 2020 and a 30 per

cent year-on-year increase in jobs seekers. The largest jobs rise

came in Q2 2021, when there was a 211 per cent jump in new jobs

available compared with the same quarter in 2020. The monitor

also showed that recruitment activity dropped for Q4 compared

with Q3 for jobs available (29 per cent) and job seekers (12 per

cent).

Source: Morgan McKinley

“Thanks to the UK’s vaccine programme and people returning to the

office, London’s financial sector is strong and thriving,

bouncing back from the poor showing of jobs across 2020. In broad

terms, the job numbers continued to reflect an encouraging

recovery from the impact of Brexit, furlough scheme, pandemic,

and lockdowns,” Enver continued. “However, there was a drop in

jobs available in Q4 due to two main factors. Firstly, the

emergence of the Omicron variant and activation of Plan B created

some uncertainty across businesses. Second, the reduced headcount

due to more people taking their annual leave at the end of the

year, and businesses closing early for Christmas.”

Rising demand for staff will boost salary levels, he

said.

“With the increase in demand from companies looking to hire

exceptional talent, this would naturally cause the price of

hiring to increase. With slightly lower volumes of job seekers

available compared to job opportunities, base salary increases

held strong, as organisations tried their best to fend off the

competition. The average change in salaries was comparable to

those of 2018 and it is expected that they will remain as such

through 2022 as competition for talent continues to dominate,”

Enver said.

The report also said that the figures showed that London has

largely avoided the negative impact of the UK’s departure from

the European Union.

“Back in 2016, there were numerous reports circulating that up to

100,000 jobs would be lost from the UK to the EU following

Brexit. Five years later, this hasn't happened and is likely

never to happen in those volumes. Many institutions have either

established a new entity abroad or enhanced their existing

operations within a European jurisdiction. However, London

continues to be a central location to conduct business,” Enver

said.

“According to the latest EY Financial Services Brexit Tracker

survey, the number of relocations from London to the EU dropped

year-on-year. Many investment banks have reconsidered their plans

and as such reduced the number of roles they will eventually

move. COVID has contributed to this with the concerns and

restrictions around travel, particularly into Europe which has

deterred many from relocating. The preference is to remain in

London and consider an alternative role here, where the markets

continue to be buoyant,” he added.

The report said that fintech has become a growth driver for jobs

in London.

According to Innovate Finance, investment into UK fintechs jumped

more than 217 per cent to $11.6 billion in 2021, second only to

US firms. The technology sector has seen £26 billion in venture

capital, record London listings, more jobs and a rise in the

number of British unicorns to 116, the report added.