Statistics

Luxembourg Greenlights 61 New Financial Entities, Industry AuM Rises

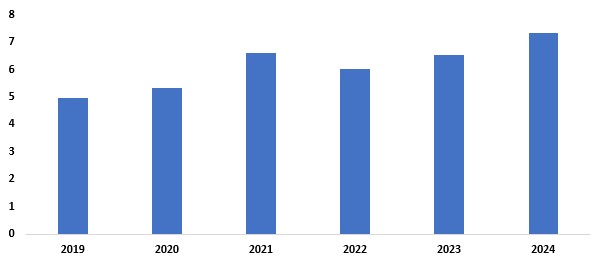

Buoyed by rising markets and inflows, the Luxembourg financial sector reports that 2024 was a strong year for growth, with 61 new organisations and entities obtaining authorisation/licensing.

Luxembourg financial regulators authorised or licenced 61 new

entities last year, while assets under management rose 11.5 per

cent from 2023 to stand at more than €7.3 trillion ($7.96

trillion).

The figures came from Luxembourg for

Finance, a public-private partnership promoting the European

principality’s financial industry. (Editor’s note: this news

service is attending next week’s ALFI Global Asset Management

Conference in Luxembourg. The jurisdiction is the largest hub for

registration of cross-border UCITS funds.)

In other details, more than 2,300 green, social, sustainability,

and sustainability-linked (GSSS) bonds were listed on the

Luxembourg Green Exchange by the end of 2024, a 23 per cent rise,

at over €1.2 trillion

Luxembourg’s life insurance logged a 41 per cent rise in

premiums, at more than €26 billion, the report said.

Among the newly-authorised/licensed entities were two new banking

institutions, Banco Inversis and Banco Votorantim; two electronic

money institutions, including LianLian Europe; five Virtual Asset

Service Providers (VASPs) including Standard Chartered and B2C2;

seven authorised alternative investment fund managers (AIFMs);

and 41 registered AIFMs. The establishment of China Taiping in

Luxembourg saw the first Chinese insurer licensed in the

country.

Detailing its assets under management, the report said growth was

strongest in alternative funds (AIFs), up by 13.2 per cent, and

they represent one-third of Luxembourg’s fund industry.

Luxembourg-domiciled AuM Growth (mutual funds and

AIFs)

Source: Luxembourg For Finance.

See this interview by WealthBriefing of ALFI

chief executive Serge Weyland, last year.