Market Research

Mapping Where Sustainable Investors Should Deploy Capital

With Earth Day approaching on 22 April, Morningstar has screened a raft of data highlighting the best (and worst) investment markets based on environmental, social and governance (ESG) criteria.

(Editor's note: in the coming weeks this news service will carry a number of articles and features on all matters relating to environmental, social and governance-driven (ESG) investing. This article sets some of the scene.)

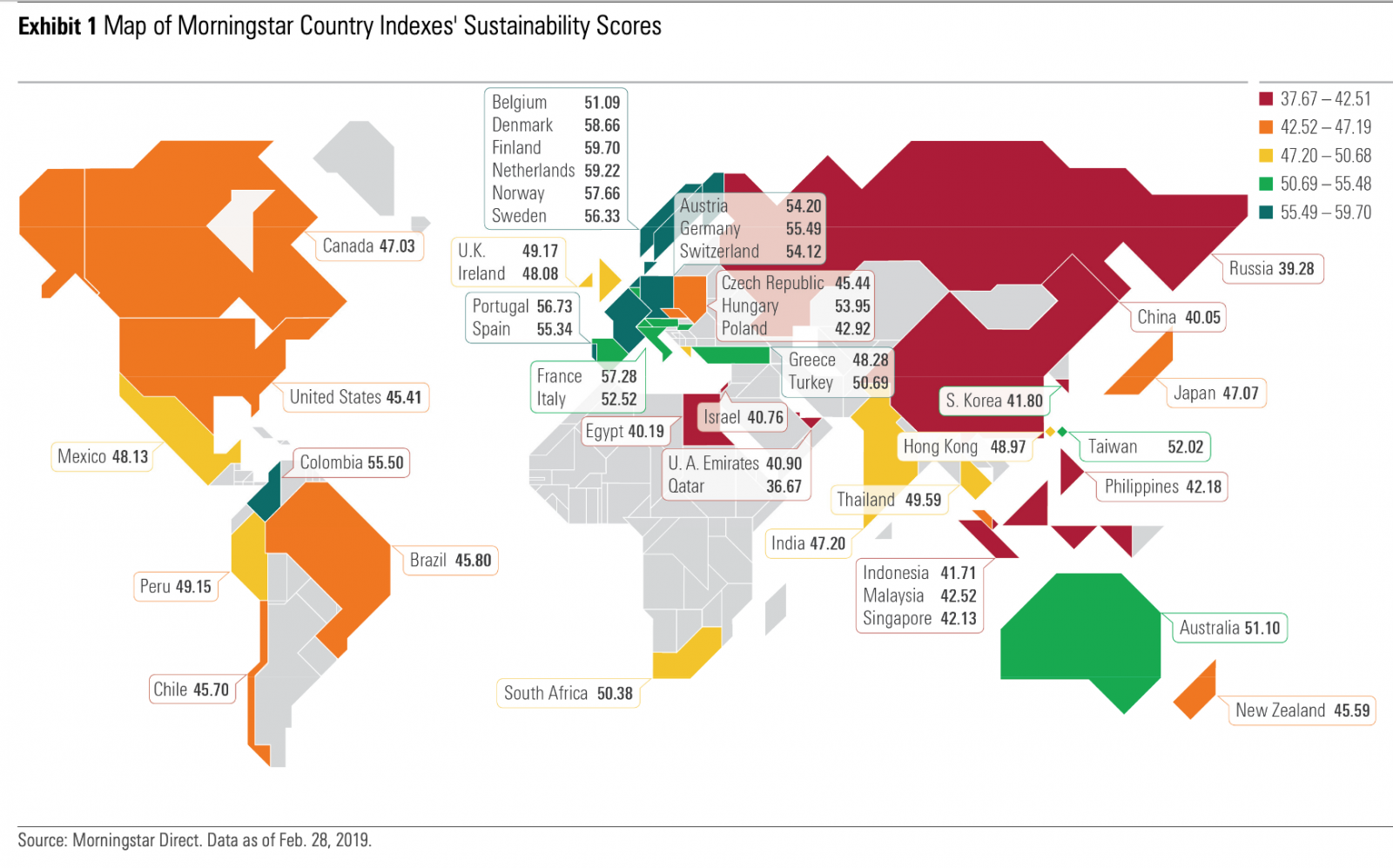

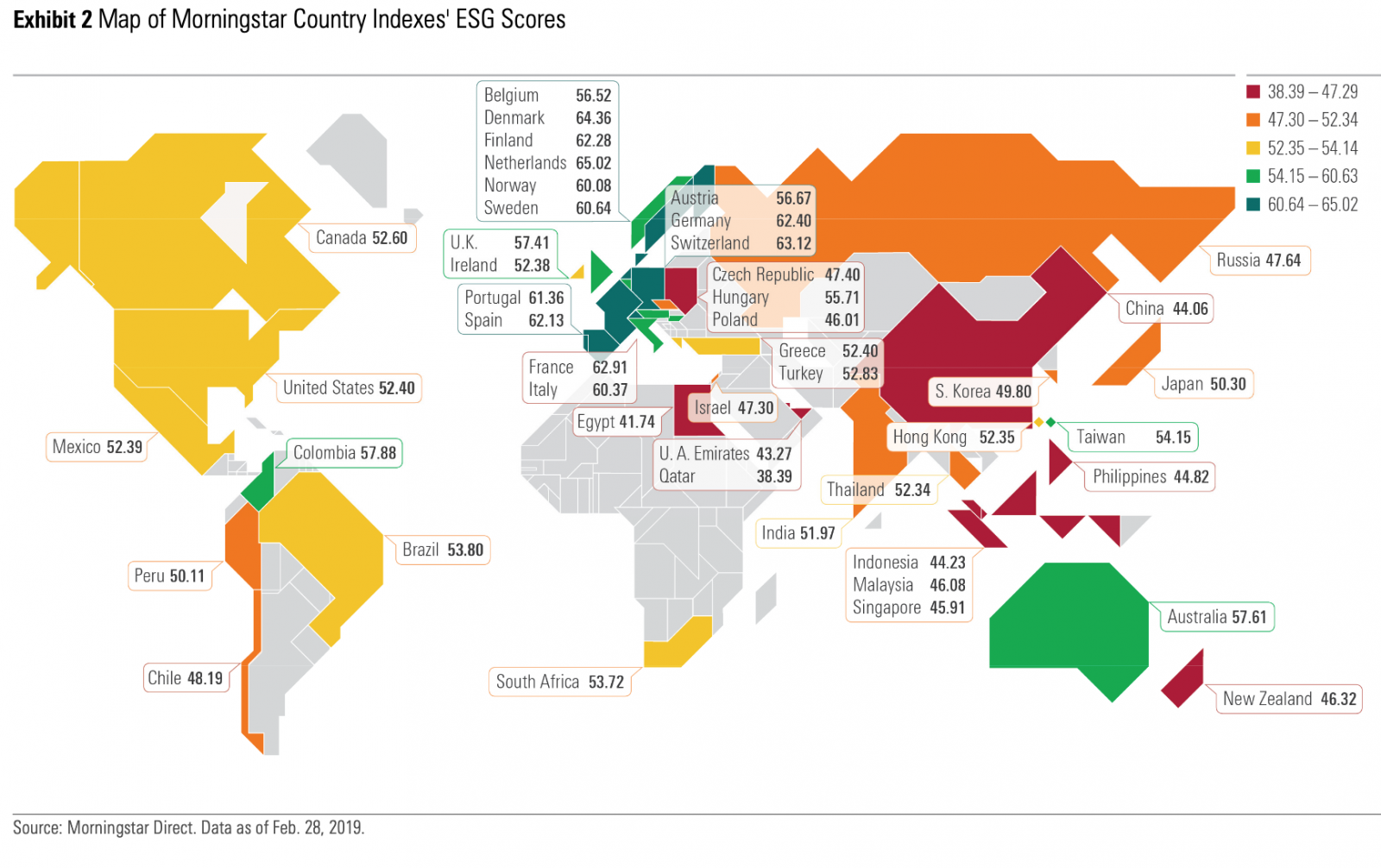

Presented as a series of maps this year, the annual Morningstar Sustainability Atlas analyses data from 46 country-specific equity indexes and company-level ESG ratings from Sustainalytics to paint a global sustainability picture. The report, using data current as of February 2019, examines the case that sustainable investing can drive positive returns and is not a fundamental drag on performance at the market level.

Unsurprisingly, on past form, the Nordic and eurozone countries were again frontrunners. Denmark scored highest on social criteria, the Netherlands on governance, and Portugal on environmental criteria, the report found.

Conglomerates make or break rankings

A potent aspect of these yearly assessments is how tied

individual company actions are to the fortunes of their host

nations. Denmark’s high score was largely driven by holdings in

Novo Nordisk, considered a leader in global pharmaceuticals;

France’s was bolstered by ESG leadership seen in the energy

company Total, pharmaceutical Sanofi, and financial services

group BNP Paribas; and Germany got a boost from strong ESG scores

from SAP, Allianz, and Siemens.

But for each positive ESG measure, a “controversy” score is also factored in - defined by Sustainalytics as any incident causing a negative environmental or social impact – which can derail otherwise high-performing countries. Switzerland dropped from third to twelfth because two large Swiss companies behaved badly.

Similarly, the UK was hampered by controversy at HSBC, Shell, and GlaxoSmithKline; Korea by controversy at Samsung; and Germany by ongoing probes at Volkswagen and Deutsche Bank. Brazil was brought down by the environmental catastrophe at the hands of Vale mining and far reaching corruption at Petrobras. Bright spots for Colombia came in financial services, with Sustainalytics scoring Bancolombia high for its strong anti-money laundering policies.

The report found markets that stay controversy-free tended to be small, but also noted that despite the financial scandal surrounding Nissan’s ex-chairman Carlos Ghosn, Japan, for a large economy, was light on ESG-related controversy.

US markets, carbon and tech provide mixed

results

Company actions also played a significant role in where the US

ranked. Workplace controversies with big constituent players such

as Amazon, Apple and Microsoft, and poor governance scores from

Facebook and Alphabet (Google) put the US in the middle of the

pack for such a highly developed economy.

But, in spite of being the world’s second-largest carbon emitter, the US scored well on exposure to carbon risk -- a criteria added for the first time this year, allowing investors to analyse how far portfolios are aligned with transitioning to a low-carbon economy and exposed to climate risk.

With 36 per cent of US market cap in healthcare and technology stocks and roughly 5 per cent in energy, US exposure was in marked contrast to that of Russia, whose nearly 60 per cent energy holdings made it the world's highest carbon risk, the report found.

Finland’s stock market was ranked the world's most sustainable, helped by Nokia (an ESG leader in the tech hardware sector) and KONE (a leader in the machinery sector).

Sustainability is still a binary picture, with parts of the world with developed economies performing the best and those with emerging economies performing the worst, breakdowns broadly showed.

China, Russia, and Middle Eastern countries were among the worst laggards, with China in the bottom quintile for all three global ESGs. Researchers attributed China’s ranking to poor governance scores from tech giants Alibaba and Tencent relative to their global peers.

“While sustainability screens add value during some periods and subtract in others, in the long term they can propel returns and privilege less volatile, competitively advantaged and financially healthy companies. Hence, claims that investors need to surrender returns to engage in sustainability are flawed,” said Valerio Baselli, senior editor at Morningstar.