Company Profiles

PROFILE: Lloyd's Of London - Its Potential For Wealth Management Clients - Conference Preview

While not for everyone in the wealth management space, the Lloyd's of London insurance market offers an interesting blend of investment returns for investors.

(This item, which appeared in March, is repeated here ahead of the Breakfast Briefing involving the Association of Lloyd's Members, and this publication, on 28 April in London. For more details on this event, and to register, click here.)

One of the oldest financial sectors in London, the Lloyd’s

insurance market has seen its fortunes wax and wane

spectacularly. After surviving near-mortal wounds in the late

1980s amid man-made and natural disasters that hit investors, the

market has been reformed. In recent years results for Lloyd’s

have been attractive. So attractive, in fact, that in this era of

modest equity market returns and fears about quantitative easing,

they look very alluring indeed.

With a history stretching back to the 17th century, Lloyd’s is

not really an insurance company so much as a subscription market

backed by a layer of mutual security, taking the form of a

“Central Fund” to which all members – corporate and individuals -

contribute and from which policyholders may be paid if a member

of Lloyd’s can’t meet its liabilities. The market has around 60

managing agents running about 100 individual syndicates which

underwrite insurance and reinsurance business for

policyholders.

This market has a language all of its own

Advocates of Lloyd’s say it gives investors the opportunity to

enhance returns – albeit by taking on a level of risk. So how is

the market doing and why should wealth managers take a closer

look? To find out more, this news service recently spoke to

Anthony Young, chief executive of the Association of Lloyd’s

Members (ALM), and Chandon Bleackley, an experienced figure in

the market. The latter takes over from Young in May, as Young is

retiring after a long career in the sector.

Young qualified as a chartered accountant with Price Waterhouse

before moving to the corporate finance department of Morgan

Grenfell. In 1989 he became the managing director of CI de

Rougement, a managing and members’ agent at Lloyd’s. He joined

the ALM as its CEO in 2000. Bleackley has worked in a number of

Lloyd's members' agents since 1989, including Christie Brockbank

Shipton, Alpha Insurance Analysts and Hampden Agencies. He spent

over 20 years working as a syndicate analyst but, in more recent

years, he has focused on marketing membership of Lloyd's to

potential new members. He joined the ALM in January

2016.

The ALM is a not for profit trade association for the individual

members of Lloyd’s, commonly known as “Names”, most of whom now

trade across a broad spread of Lloyd’s syndicates with limited

liability, through companies or limited liability partnerships

(LLP) in which they are the only investor. Names now provide only

about 10 per cent of Lloyd’s capital. The rest comes from larger

companies, mostly insurance companies. The ALM board is entirely

constituted of people who are themselves Names at Lloyd’s.

“Names at Lloyd’s enjoy the double use of assets (ie they retain

the dividend or other income from the assets which they place in

trust at Lloyd’s to provide security for policyholders and they

add to this the underwriting and investment results of their

syndicate participations). Their underwriting results are largely

uncorrelated with other investments, and they also benefit from

valuable tax advantages. The Lloyd’s market today is one of the

primary global hubs for reinsurance and specialty insurance

business, partly due to its status as a subscription market that

is backed by a mutual Central Fund, which in turn brings with it

the twin advantages of greater capital efficiency and a central

body which assists its component parts to consistently outperform

its peer group of other insurers,” the men told this

publication.

“Most people who now consider joining Lloyd’s are middle-aged

professionals, generally based in the UK. Most of them are

generally employed in finance or the law, or are entrepreneurs

who have built up and successfully sold their business. The main

reasons that they are interested in joining as Names are because

they are attracted by the fact that the market can be viewed as

an alternative, largely uncorrelated asset class that has

produced some good returns to its Names in the past,” the men

said. “They [Names] also benefit from the double use of assets

that Lloyd’s allows, and the fact that there are significant

potential tax benefits associated with membership. Tax issues and

estate planning are undoubtedly one of the factors for new Names

wishing to join the market,” they said.

The ALM likes to cite a report on the market’s track record and

potential by Professor Tim Congdon, a prominent UK economist. In

a paper entitled How profitable is Lloyd’s

underwriting? (June 2007), Congdon crunched the numbers

for Lloyd’s over the period 1950-2005 inclusive (including two

periods of heavy losses, 1989-1992 and 1998-2001) and concluded:

“It follows that an equities-based investor who puts all his or

her capital into Lloyd’s as FAL [funds at Lloyd’s] should

eventually double the return on capital”. (NB. In fact, Names

would generally be advised not to put more than a small

proportion of their assets into Lloyd’s as it is still a high

risk investment.)

Bleackley and Young said: “In the past, when all Names underwrote

on an unlimited liability basis, there were more older, retired

people as Names, and many of these were asset-rich, cash-poor

people who were looking to derive an additional source of annual

income from their Lloyd’s membership. A considerable number

of these people had inherited wealth, often in the form of

property or land, which they wished to use to derive an

additional source of income by using their assets to capitalise

their Lloyd’s underwriting, often via a bank guarantee secured on

such assets which could be called upon by Lloyd’s to pay claims

if the Name was unable to find the cash. In some cases, some of

these people had over-geared themselves and therefore found it

hard to pay their losses.” In contrast, the losses of Names with

limited liability are limited to the assets of the companies or

partnerships through which they trade.

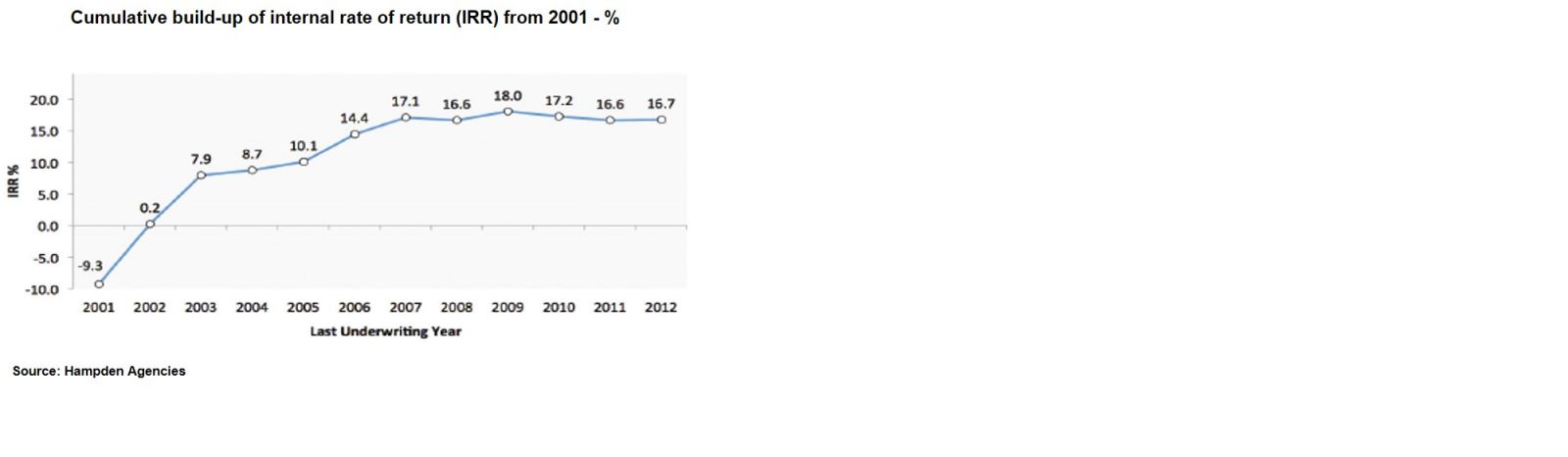

From 2001 to 2012 (the last year for which data is currently

available under the three year accounting basis for the payment

of profits at Lloyd’s), the cumulative internal rate of return

for the average Name who traded throughout that period was about

16.7 per cent, and that includes the heavy losses incurred in

2001 as a result of the terrorist attacks on the World Trade

Centre and the two record years for natural catastrophe claims,

being 2005 and 2011. (IRR takes account of different timings of

entry and exits into and out of investments.)

Here is a chart to illustrate:

Prices are now high because very little new capacity is becoming

available (ie supply is tight), and also because Names are not

selling much existing capacity. The most likely cause of a future

drop in prices would be if substantial new capacity were made

available, probably largely by pre-emptions on existing

syndicates if conditions in insurance markets were to improve so

that the managing agent wishes to expand the syndicate. By and

large the price is determined by Names buying and selling,

although sometimes the managing agent might also try to buy

capacity on its own syndicate.

Why recruit more Names?

Names’ capacity amounts to about 10 per cent of the overall

market capacity. If that capacity drops below 10 per cent then

the number of external Names elected onto the Council of Lloyd’s

will be chopped from two to just one, probably in 2019. More

Names will mean these investors will have more influence on the

market, and will also allow more Names’ syndicates to be formed,

thus providing Names with greater choice. (“Capacity” means the

amount of premium income a syndicate or Name can underwrite.)

There are more than 180 firms of insurance and reinsurance

brokers working at Lloyd’s, many of whom specialise in particular

classes of business, but about half of it is brought in by the

"Big Three" of Aon, Marsh and Willis. To be accredited, each

Lloyd’s broker must show that it understands the

market.

Since the early 1990s reforms, Lloyd’s is now capitalised by

large dedicated corporate members, only underwriting on their own

managed syndicates and by third party members, mostly spread

across a wide spread of syndicates. The vast majority of the

latter are the Names. Corporate members were first introduced

into Lloyd’s in 1994. Prior to that time, Lloyd’s was exclusively

capitalised by third-party, unlimited liability members. In the

late 1980s, the number of these unlimited liability members of

Lloyd’s peaked at about 34,000. (No new unlimited liability

members have been permitted to enter the market since

2003.)

As a normal rule, profits (or losses) are only paid out (or

collected) after three years. So for example, the profits of

business underwritten in 2016 are only calculated as at 31

December 2018 and are paid out in May 2019. However, cash calls

may be required earlier than this following abnormally high

claims activity. And yes, there are tax breaks, including the

possibility of getting 100 per cent Business Property Relief

against inheritance tax.

A Name trades on a portfolio of syndicates that are chosen in

conjunction with his members’ agent. After 36 months, the

syndicates calculate their individual profits and losses, and the

Name’s shares of these are aggregated together to produce his

annual result, which is normally expressed as a percentage of his

capacity. Thus, a typical Name, with £1 million of capacity, who

achieves a profit of £100,000 in a given year of account, is said

to have achieved a profit of 10 per cent of capacity.

Other details

There are some other terms and pointers for wannabe Names to bear

in mind. Each Name’s members’ agent charges an annual fee and may

also charge a profit commission for its services. Also, each

syndicate at Lloyd’s is an annual venture, normally renewable at

the end of each year, at the option of the Name. Each year of

account runs for 36 months. Each Name essentially “puts up”

or lodges capital each year, known as funds at Lloyd’s, which

provides part of the necessary policyholder’s security to enable

syndicates to underwrite insurance and reinsurance risks.

The required investment to become a Name at Lloyd’s is very

largely made up of the cost of acquiring capacity on syndicates

(ie the right to a particular premium limit on those syndicates)

plus the funds at Lloyd’s (FAL) requirement. Capacity may

generally only be acquired in the capacity auctions, which take

place in October each year and which are normally highly

illiquid, so that prices can sometimes be very volatile. The more

highly regarded syndicates tended to cost about 60 pence to

70 pence per £1 of capacity in the latest auction season, but the

less well regarded syndicates cost as little as 0.1 pence per £1

of capacity, and capacity on new syndicates, or on those

syndicates on which there is no security of tenure for longer

than one year, tend to cost nothing at all. Including such

syndicates, the average value of a well-spread portfolio of

syndicates in the most recent auction season was in the region of

40 pence per £1 of capacity.

The size of each Names’ FAL requirement is largely calculated as

a percentage of “capacity”. The capacity of a syndicate or a Name

is the limit to the gross premium income, excluding brokerage,

which it may underwrite in the given year. This percentage will

be higher or lower depending on the risk profile of the planned

business, but for a Name with a spread across many syndicates it

will normally be about 50 per cent of capacity.

An alternative, and perhaps easier, way to become a Name is to

buy an existing company (known as a “Nameco”) or LLP from a Name

who wishes to sell. Each members’ agent publishes on its website

details of all such vehicles which are available for sale at any

one time, and each members’ agent is normally prepared to advise

potential Names in connection with the acquisition of such an

entity.

The FAL can be in cash, bonds and/or shares, and/or letters of

credit or a bank guarantee, either of which can be backed by an

asset that the bank will accept as security although it should

not be backed by the Name’s principal private residence.

Syndicates underwrite insurance business in several different

currencies. Typically, about 60 per cent of the business

underwritten in Lloyd’s is underwritten in US dollars. This means

that there is an exchange rate risk.

They earn an annual investment return, including capital gains

(or losses), on the premiums that they receive and on the

reserves put by to cover losses not yet paid. The investment

strategy pursued by most syndicates is very conservative and

usually involves a portfolio built around cash and high grade

short duration bonds (mostly US and UK).

In summary, this is a complex market and with a language and

approach that is very different from, say, playing in mainstream

equities, or even venture capital and fixed income. However, at a

time when the search for tax-advantaged, and hopefully,

lowly-correlated returns has been boosted by the woes of the

stock market this year, the Lloyd’s market might find a new wave

of interest.

Click here for details on an upcoming event hosted by this publication on the opportunities and challenges of the Lloyd’s insurance market in relation to wealth managers.