Trust Estate

UK Government Continues "War On Trusts", Suffocating Sector, Says Law Firm

These stats come as the government continues its tax crackdown, which has seen a drop in legal tax planning schemes, such as trusts, due to the heavy regulation.

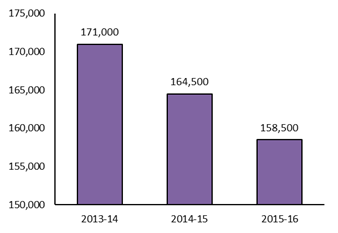

The number of overall trusts in the UK fell 4 per cent from

164,500 in 2014/15 to 158,500 in 2015/16, according to the latest

statistics from HMRC, the nation's taxman.

This comes as the UK government continues to crackdown on tax

evasion, as it looks to delve into all the layers surrounding the

trust industry.

There are a number of reasons for setting up trusts,

including:

• To control and protect family assets

• To pass on money or property while the settlor is still

alive

• To pass on money or assets when the settlor dies, under the

terms of their will

• When someone is too young to handle their affairs

• When someone cannot handle their affairs because they are

incapacitated

Recently, in line with the current transparency agenda in the

financial sector, and in compliance with European Union

regulations, HMRC introduced a new trusts register which records

all UK and non-UK trusts that have a UK tax liability. The

register captures information on all relevant parties to a trust,

including the settlor and beneficiaries (whether actual or

potential) as well as certain advisors to the trust. The

register is not public.

As it introduces tax changes and new regulatory requirements

designed to tackle tax evasion and money laundering, the

government has been making trusts look rather undesirable to

individuals. Also it has made legitimate tax schemes seem illegal

and made innocent individuals look as if they are committing a

crime.

James Badcock, partner at law firm Collyer Bristow,

said: “The government is continuing its war on trusts, and many

everyday users of trusts have been collateral damage in this.

Taxpayers trying to undertake legitimate and prudent estate

planning are becoming victims of punitive tax changes and

time-consuming new regulatory requirements.”

He added: “Trusts have been out of the Government’s favour since

at least 2006. Trusts are a standard part of estate planning for

a huge number of “middle England” families, and heavy restriction

has made this much more difficult. If used correctly, trusts can

be very beneficial for estate planning – particularly for life

policies, or for entrepreneurs for passing down or selling their

family business.”

Graph 1: The decline in the number of UK trusts

Source: Collyer Bristow