Company Profiles

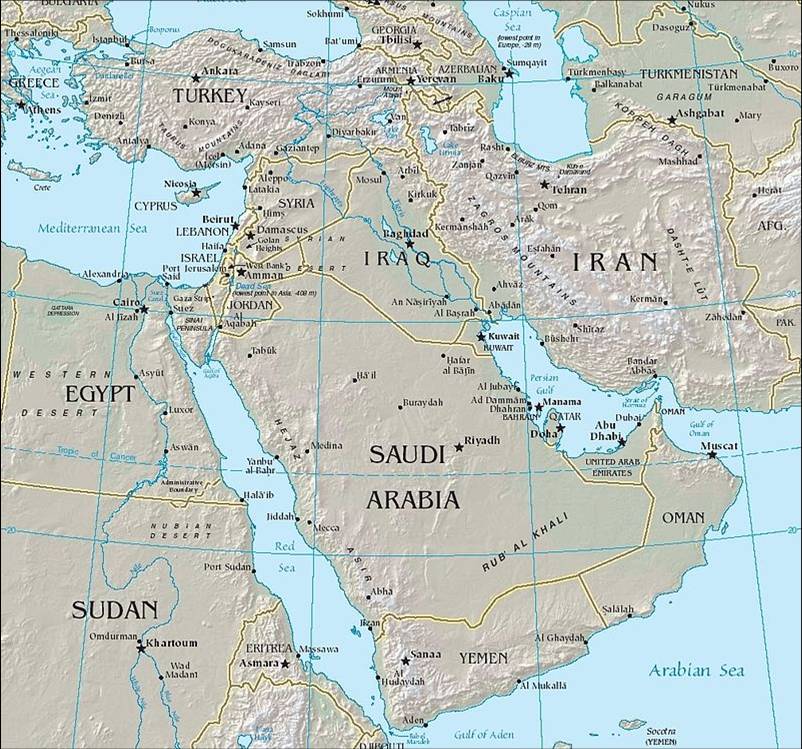

Local Partnerships: FundCount's Middle East, Africa Expansion

FundCount recently picked up awards from WealthBriefing in the MENA region and this news service recently quizzed the international firm about its strategy in the area.

FundCount, the

US-headquartered business that provides accounting and investment

analysis software for wealth managers and family offices

worldwide, is upbeat about its work in the Middle East and

Africa. And that’s unsurprising after it

scooped two awards at this news service’s MENA region gala

event held in Dubai a fortnight ago.

Working with partners in places such as Mauritius – giving it

great access to the Africa market – FundCount integrates its

offerings with existing solutions that local clients have. This

reduces costs for clients in what is often a price-sensitive

market, Alex Ivanov, chief executive and co-founder of the firm,

told this publication.

“The competition is different in the MENA region than the

Americas or EMEA and with our historic success in the Middle

East, we’re well-positioned to take advantage of the needs

there,” Ivanov said.

Commenting on Africa specifically, Ivanov said FundCount needed a

local footprint – which it gained through a partnership with a

Mauritius-based fund administrator. Using FundCount, the firm is

delivering expertise locally and helping family offices with

accounting and reporting to gain insights from their data, an

area of growing importance, he said.

Mike Slemmer, chief operating officer, Americas, told this

publication that FundCount is working on ways that local clients

can fit their systems with the firm’s offerings and restrain

costs. “With local [African] firms we have to be more creative

with our solutions,” he said.

The MENA region is another dimension to a firm that serves more

than 130 single and multi-family offices, fund administrators,

private equity and hedge funds firms worldwide, with assets

totalling more than $150 billion. It has offices in Boston,

Zurich, London, Singapore and Sydney. Globlly, the firm has more

than 50 staff and revenues are up 22 per cent this year.

Middle East

The Middle East market, meanwhile, is a significant one for

FundCount, given the considerable family offices space and other

wealth management entities in that region, Slemmer said. In

certain respects this market is not different in kind from the

other markets in which FundCount operates.

Asked how the firm matched up to targets at the start of the

year, Slemmer said FundCount had “met and exceeded

expectations…penetration of the single family office space is

good….we have signed up some significant SFOs in the UK as well

as in the Middle East”.

The firm is poised to announce new capabilities to integrate with

“best of breed” applications, so the next few months are going to

be busy for FundCount, he said.

In March this year this news service issued a report, “Family

Office Focus: Efficiency in Accounting and Investment Analysis”

in conjunction with FundCount. The report examined family offices

through a survey of 44 firms and interviews with 20 senior

executives representing over $72 billion in assets under

management.

(The firm won Best Client Accounting Solution and Best Client Communications Solution awards this year in Dubai.)