Investment Strategies

How Will Earnings Look After COVID-19?

The private bank asks what equity investors can and should do to prepare for when - hopefully - earnings and valuations increase once the virus pandemic is past.

The following commentary is from Julien Lafargue, head of

equity strategy at Barclays Private

Bank. He talks about what equity investors should be doing in

the current fraught environment. The editors are pleased to share

these views; the usual editorial disclaimers apply to comments

from outside contributors. Email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

The spreading coronavirus pandemic has savaged equity valuations

in spite of unprecedented fiscal and monetary responses around

the world. What can equity investors do as the pandemic unfolds

to prepare for an eventual rebound in earnings and

valuations?

No consensus

For long-term investors, the trajectory of earnings matters much

more than the short-term gyrations in valuations. However, at

this point in the spread of the coronavirus pandemic, making

assumptions on future profit growth are almost impossible. Even

companies are withdrawing 2020 guidance by the dozen.

When it comes to global equities, the bottom-up consensus

forecast points to 6.5 per cent earnings growth in 2020 and 11.5

per cent in 2021. These numbers should be bluntly ignored.

Looking at top-down strategists, revisions have been numerous in

the past few weeks and numbers currently range between a 5 per

cent decline to a 20 per cent drop in earnings this year. Few

venture to say a word about 2021.

History as a guide

We face an unprecedented situation and history may not be a

reliable guide this time around. Yet, this is what most investors

will look to in the search for some guidance. Considering the

last 30 years, global equities have suffered three major earnings

drawdowns (1992, 2000 and 2008). In these periods, earnings, on a

trailing basis, contracted by around 35 per cent.

While investors usually rely on forward looking measures, in

current circumstances, we believe this is too subjective. Based

on this measure, it suggests that having dropped around 30 per

cent from their recent peak, market valuations already reflect

most of the upcoming downgrades.

It’s all about the rebound

Unfortunately, attractive valuations are usually not sufficient

to justify a rally. In addition, investors need to see the light

at the end of the tunnel, in the form of an earnings recovery,

before a sustained bounce is likely.

Based on the information available, one could reasonably assume

that, once the COVID-19 pandemic is under control, economic

activity will gradually return to normal (as seems to be

happening in China). Thanks to a significantly depressed base,

year-on-year profit growth should then be meaningful. We are

unlikely to make up for all the economic damage caused by the

coronavirus outbreak due to some lag effects (unemployment

staying durably more elevated for example). Nonetheless, it

appears reasonable to anticipate a strong recovery in

earnings.

Magnitude and timing

The magnitude of the eventual rebound remains uncertain and so

does its timing. Here, again, we can turn to history for clues

but due to the unique nature of the threat we face, any

indication is to be taken with a pinch of salt.

Never have we seen such a violent bear market (appearing in just

16 days from peak), nor the level of stimulus central banks and

governments have already committed to. Still, it usually takes a

few years (around 3.5 on average) for earnings to recoup their

drawdowns. While this number may not bode well for 2021 earnings,

it also means that, based on historical patterns, earnings could

grow at a compound rate of around 15 per cent in the next three

years.

Question marks remain around valuations

While earnings dictate long-term upside potential in equities,

valuations move in tandem with the short-term price action and

are influenced by many factors. As such, we are, just like

valuations, tempted to revert back to the mean which, in the case

of global equities, is around 15.5 times forward earnings and

18.2x trailing.

Assuming earnings collapse by 35 per cent before recovering half

of these losses by the end of 2021, then the market appears

fairly valued in our opinion. However, this simple exercise does

not take into account that several trillions dollars-worth of

stimulus have been pumped into the economy and that interest

rates are as depressed as ever. This would suggest that

valuations have room to stay above their historical average for

the foreseeable future.

Time for value?

While some investors may prefer to hide in the current

environment, some are on the hunt for bargains. Usually their

attention is focused on the sectors and companies that have been

most exposed to the threat that caused the initial sell-off.

This would have been technology in 2000 or banks and real estate

in 2009. Indeed, “value” stocks, whose earnings are likely to be

erased during a recession, tend to enjoy the strongest initial

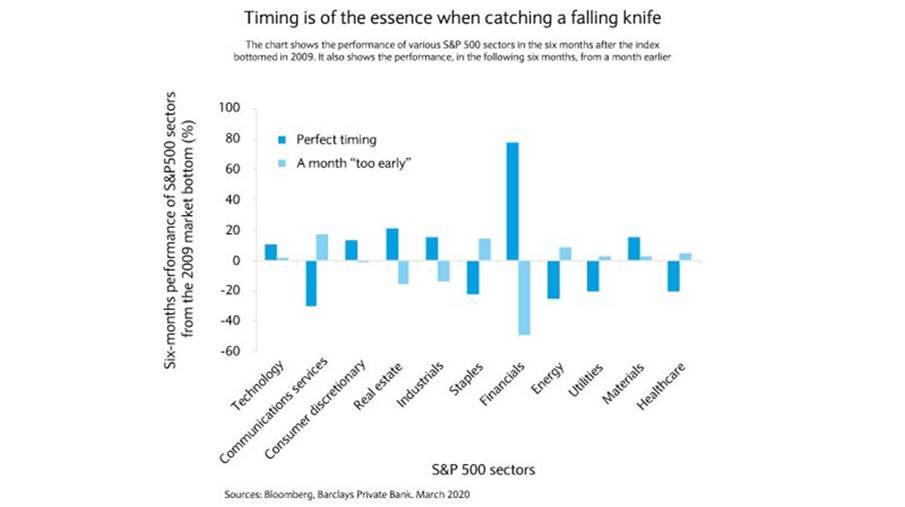

rebound. However, looking at what happened in the US in 2009, in

order to benefit from this outperformance of value, good timing

was essential (see chart).

Focus on quality

Should our base case play out (limited long lasting impact of

coronavirus with a recovery starting in the second half of this

year), we would expect value to outperform initially. Financials,

energy (assuming a quick recovery in oil prices) and travel and

leisure are likely to lead the way.

Europe would also probably outperform the US. However, we would

see this as a trade rather than a new paradigm. In addition,

while we would tilt towards value, we would do so with an eye on

quality as the shockwaves from the COVID-19 crisis would probably

take time to work their way through.

For the above reasons, proceeding with extreme caution seems

warranted when it comes to picking up stocks in airlines or

cruise line companies, for example. Many may need to be bailed

out and still may not survive in the long run. In our opinion,

whether it is value or growth, in recession or expansion, quality

remains key to enjoying the long-term potential benefits of

compounding growth.