Statistics

Data Highlights Major Banks' COVID-19 Pain

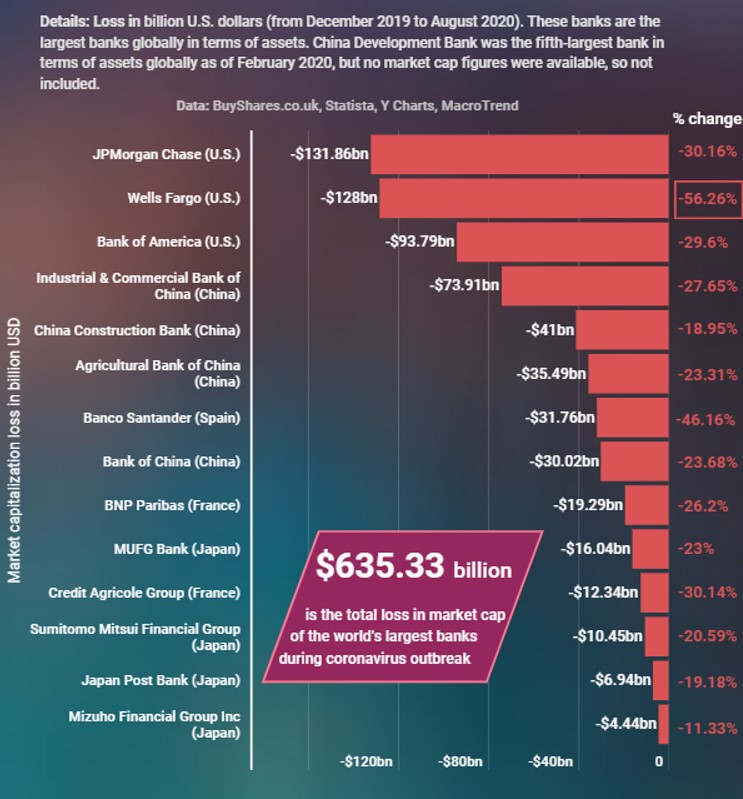

Here is a strikingly visual representation of the scale of losses to banks' market capitalisation wrought by the pandemic.

A study of the world’s 14 largest banks shows that they lost

$635.33 billion in market value from December 2019 through to

August this year, highlighting the scale of COVID-19’s impact on

the financial sector.

Figures from Buy Shares, a financial information and education

platform, noted that Wells Fargo recorded the biggest slump with

a percentage change in the market capitalisation at -56.26 per

cent followed by Spain’s Banco Santander at -46.16 per cent. JP

Morgan’s market cap sagged by 30.16 per cent over that period. In

the same timespan, Japan-based Mizuho Financial Group fell by the

least of the 14 groups measured, down by 11.33 per cent.

“The drop in valuations for the selected banks could have been

much worse if there was no intervention from central banks,” the

report said. “The immediate measures taken by regulators to ease

restrictions on liquidity and capital, banks have proved

beneficial. Although the measures put in place by authorities

helped banks, they still face some immediate pressures on their

capital and liquidity position, as the length and severity of the

outbreak remain uncertain.”

“After the pandemic, most banks should leverage on digital

banking to keep their business afloat. Traditional banks that

take lessons from digital financial institutions will find

themselves more prepared to compete with challenger banks even

after the coronavirus pandemic. Before the pandemic, challenger

banks were already on the rise, posing a great competition for

traditional banks," the report continued.

“Early indicators show that most banks will struggle to generate

profits due to a sustained period of low-interest rates in the

course of the health crisis. Despite the gloomy future in regards

to profitability, banks need to start plotting their

post-COVID-19 future,” it added.

Source: Buy Shares.