Asset Management

Cryptos Are Here To Stay - But Be Careful

Bitcoin hit $42,000 a coin earlier this month, a rise of 300 per cent since October. Questions abound over its viability. Here Barclays' chief strategist examines its prospects as a portfolio contender.

Bitcoin is rarely out of the frame, either for hitting new records, or as reported by a crypto recovery service this week, for the $140 billion stranded in wallets because bitcoin owners have forgotten their passwords. Barclays Private Bank chief market strategist Gerald Moser considers the progression of cryptocurrencies and whether it's time to add them to portfolios. The editors welcome this commentary, where the usual disclaimers apply. Email feedback to tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com.

There has been a lot of talk about bitcoin, and cryptocurrencies in general, being a “digital” gold. Similar to gold, there is a finite amount, it is not backed by any sovereign and no single-entity controls its production. But for bitcoin to be considered in a portfolio and to become an investable asset, similar to gold, the asset would need to improve the risk/return profile of that portfolio. This seems a tall order.

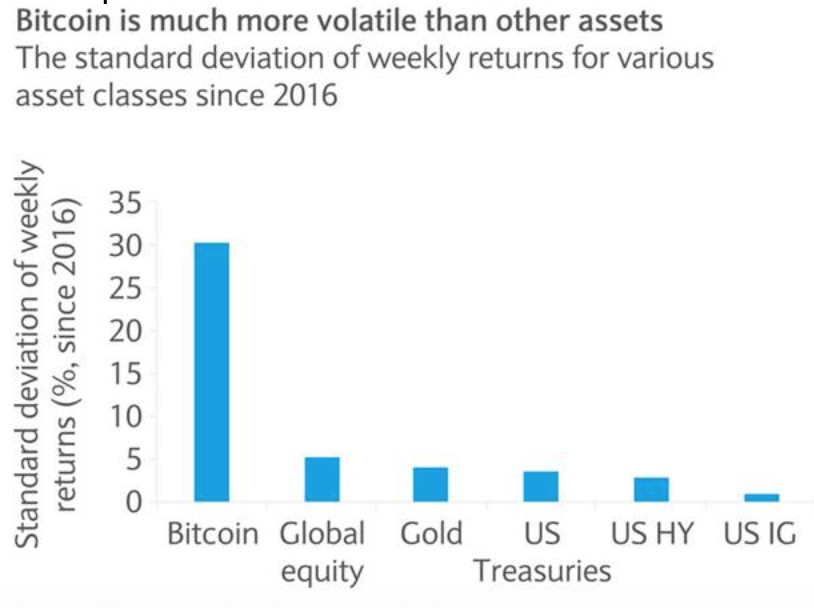

While it is nigh on impossible to forecast an expected return for bitcoin, its volatility makes the asset almost “uninvestable” from a portfolio perspective. With spikes in volatility that are multiples of that typically experienced by risk assets such as equities or oil, many would probably throw the cryptocurrency out of any portfolio in a typical mean-variance optimisation.

Source: Bloomberg, Barclays Private Bank

Poor diversifier

And while bitcoin’s correlation measures are relatively

supportive, it seems to falter when diversification is most

needed, such as during sharp downturns in financial markets.

Looking at weekly return correlations since 2016 shows that

bitcoin is not strongly correlated with any assets (see below).

It is, however, only second to US high yield in its correlation

with equities. US Treasuries, gold and US investment grade were

better diversifiers than bitcoin when it comes to equities.

chart2.jpg)

Source: Bloomberg, Barclays Private Bank

Furthermore, looking at global equity corrections since 2015 (see below), it is noticeable that bitcoin has performed even worse than equities over the last three corrections. And while gold and fixed income provided some relief during those corrections, bitcoin compounded the loss that investors would have incurred from equities exposure.

The fact that cryptocurrencies also fluctuate alongside equities suggests that investment in bitcoin is more akin to a bubble phenomenon rather than a rational, long-term investment decision. The performance of the cryptocurrency has been mostly driven by retail investors joining a seemingly unsustainable rally rather than institutional money investing on a long-term basis.

Several studies around market structure have shown that emerging markets with high retail/low institutional participation are more unstable and more likely to be subject to financial bubbles than mature markets with institutional participation. And while more leading financial houses seem to be taking an interest in cryptocurrencies, the market's behaviour suggests that the level of institutional involvement is still limited. Another concern is around its concentration: about 2 per cent of bitcoin accounts control 95 per cent of all bitcoins.

In summary, difficulty to forecast return, lack of diversification and high volatility makes it hard to consider bitcoin as a standalone asset in a diversified portfolio for long-term investors.

An inflation hedge?

Another point widely quoted in favour of cryptocurrencies is that

they provide an inflation hedge. This might be a valid point, if

inflation stems from fiat currency debasement. As mentioned

above, a currency’s worth comes from the trust economic agents

have in it. If unsustainable amounts of debt and large money

creation shatter belief in sovereign-backed currencies through

spiralling inflation, cryptocurrencies could be seen as an

alternative.

Regardless of its price, bitcoin’s production is set on a precise schedule and cannot be changed. If oil or copper prices go up, there is an incentive to produce more. This is not the case for cryptocurrencies. In a very specific and highly hypothetical scenario of all fiat currency collapsing, this could be positive. But other real assets such as precious metals, inflation-linked bonds or real estate usually provide a hedge against inflation.

Other considerations

Bitcoin’s technology should theoretically make it extremely

secure. As there is no intermediary, each transaction is reviewed

by a large number of participants which can all certify the

transaction. However, there have been frauds and thefts from

exchanges. Another point to consider is the risk of “losing”

bitcoins. According to the cryptocurrency data firm

Chainanalysis, around 20 per cent of the existing 18.5 million

bitcoins are lost or stranded in wallets, with no means of being

recovered. As there is no intermediary, there is no backup for a

lost bitcoin.

From a sustainability point of view, adding cryptocurrencies to a portfolio will make it less green. Mining and exchanging them is highly energy intensive. According to estimates published by Alex de Vries, data scientist at the Dutch Central Bank, the bitcoin mining network possibly consumed as much in 2018 as the electricity consumed by a country like Switzerland. This translates to an average carbon footprint per transaction in the range of 230-360kg of CO2. In comparison, the average carbon footprint of a VISA transaction is 0.4g of CO2.

Beyond energy use, the mining process generates a large amount of electronic waste (e-waste). As mining requires a growing amount of computational power, the study estimates that mining equipment becomes obsolete every 18 months. The study suggests that the bitcoin industry generates an annual amount of e-waste similar to a country like Luxembourg.

Cryptocurrencies are here to stay

Innovation in digital assets continues rapidly and is likely to

drive increased participation, both from retail and institutional

investors. The underlying blockchain technology behind bitcoin

was meant to disrupt a few different industries. While results

have not lived up to the initial hype, more sectors are

investigating the use of the technology.

And with Facebook announcing a stablecoin, or a cryptocurrency pegged to a basket of different fiat currencies, central banks have accelerated the movement towards central bank digital currencies. Those could improve payment systems resilience and facilitate cross-border payments.