Technology

What Do Wealth Clients Want from a Digital Proposition?

Here is a sponsored article from FactSet on an important theme within the global wealth management industry.

The following article comes from Greg King, CFA, of FactSet.

The notion that wealthy clients (with more than $2.5 million in

investable assets) want a primarily human-led wealth management

relationship was under review long before the pandemic. Since the

onset of COVID-19, this idea has essentially been rejected as

more evidence emerges showcasing a positive relationship between

a well-delivered digital proposition and overall client

satisfaction.

Most firms understand the importance of delivering a quality

experience to clients across their wealth management journey.

Research also shows that satisfied clients tend to hold more

investable assets with their wealth management firm. A digital

mindset is therefore no longer a “nice to have” but a genuine

differentiator - and revenue generator for firms.

Our latest study, in collaboration with Aon, uncovers the

specifics behind what makes a digital service stand out, and the

impact on financial confidence and attitude to risk taking. It

highlights actionable steps wealth management firms can take to

make digital propositions more targeted and relevant to wealthy

clients and their advisors.

The Digital Divide

Over the last decade, wealth management has been undergoing a

protracted digital transformation, unsure to what extent it

should let technology play a role in its relationship-driven

business model. But the pandemic has shown how closely

intertwined the two aspects are.

The quality of the online wealth management experience,

particularly during uncertain times, can visibly impact a

client’s financial confidence and willingness to ramp up or wind

down risk. For example, our study finds that investors who give

wealth managers top marks for their digital capabilities, tend to

feel more confident about their financial futures than their

counterparts (48 per cent vs. 26 per cent).

Technology offers greater control and oversight over investment

portfolios. Consequently, it may be the reason why a higher

proportion of wealthy clients say they have “adventurous”

attitudes to growth of capital strategies, than those whose

digital experiences are merely average (12 per cent vs. 5 per

cent).

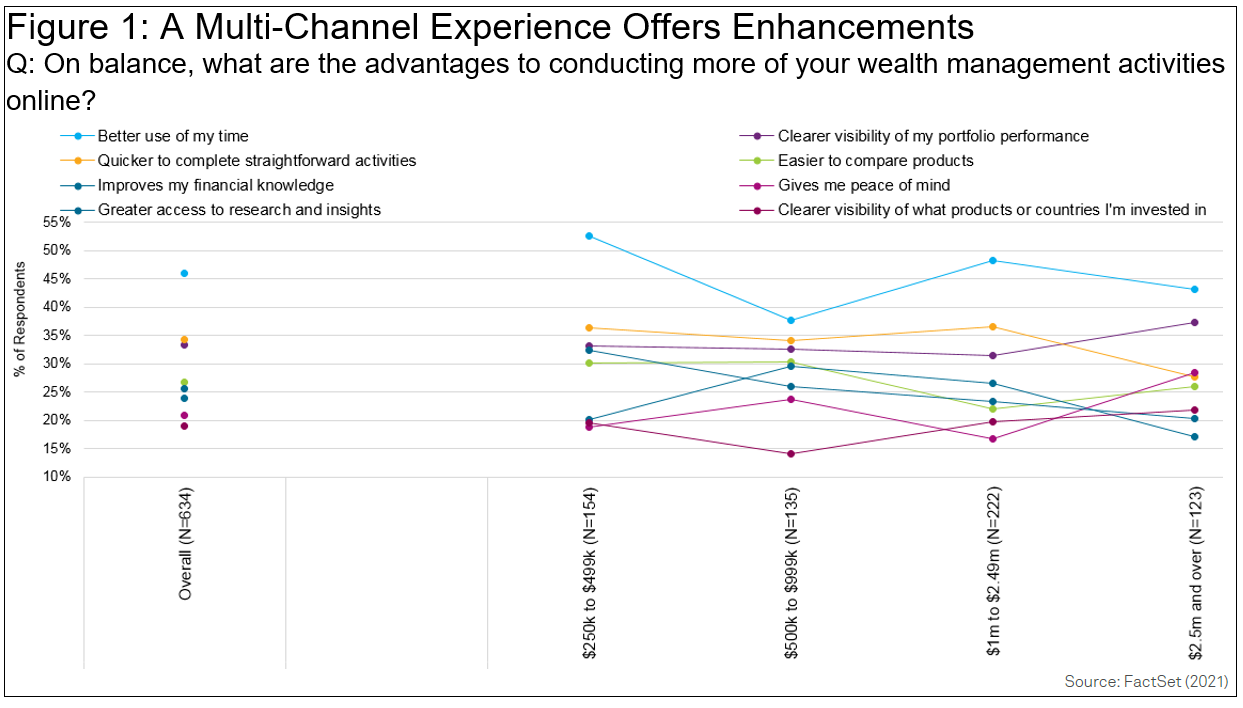

Over a third (35 per cent) of HNW investors give their wealth

management firm top scores for its digital capabilities (vs. 18

per cent of mass affluent). Like other segments, they feel one

critical advantage of digital wealth management is better use of

their time [Figure 1]. To them, a multi-channel experience offers

enhanced portfolio management, including greater visibility over

performance of their investments and clarity on products and

countries to which they’re exposed.

Figure 1: A multi-channel experience offers

enhancements

Q: On balance, what are the clear advantages to

conducting more of your wealth management activities

online?

And while many genuinely feel they are receiving a good

experience so far, there are some emerging concerns for wealth

managers to address. For example, 23 per cent say it is harder to

maintain a personal connection with their advisor, while others

point to worries over platform security and even identify theft.

These concerns are unlikely to abate, so it’s important for firms

to find solutions.

Think Big, But Start Small

Too much technology can seem like a blocker, rather than an

enabler to deepening client relationships. And perhaps this is to

be expected if new tools, channels, or technology require

cumbersome changes to longstanding behaviors.

If wealth managers want to make the digital transformation of

2020 a permanent behavioral shift - firms need to make changes

simple and easy to embrace. We see this thinking evidenced in our

data. Wealthy clients are open to completing nearly half (45 per

cent) of their wealth management activities digitally - a

noticeable increase from pre-pandemic levels (37 [per cent);

however, some elements are missing.

To make the proposition more meaningful, nearly three in five (58

per cent) HNW investors highlight improvements, like the need to

make customization easier (21 per cent) and greater focus on

collaboration tools (17 per cent) [Figure 2]. These improvements

could help alleviate the frictions that make it difficult to have

a personal client-advisor relationship.

Figure 2: Take steps to improve the digital experience

Q: Thinking about your wealth relationship holistically,

is there anything missing from the digital experience offered to

you today?

The Missing Link

It continues to surprise some in the wealth management industry

that wealthy clients want to engage more meaningfully with the

investment process. According to our research, the ideal digital

wealth proposition combines advisor accessibility with

high-quality market data and customized reporting. The missing

link, however, is understanding the relevance of tools available

and confidence in using them.

In terms of service, the most important features for wealthy

clients are ease of access to their investments (important to

84%), alongside tasks being completed efficiently by their

advisors.

Wealthy clients feel a range of tools can have a powerful

enabling value in the management of their wealth, particularly

executing trades independently (57 per cent) and the ability to

access, export, and interrogate high-quality market data (54 per

cent).

On content, they value up-to-date information on their

portfolios, access to market data, and reporting that is tailored

to their understanding.

Given that many investors are increasingly open to completing the

end-to-end investment process virtually (rather than in person),

advisors should be more actively using some of their firm’s

online tools together with their clients. A move towards a hybrid

model would allow wealth managers to incorporate clients’ digital

appetites and willingness to embrace online tools to elevate the

overall experience, financial confidence, and improve their

productivity.

Conclusion

Behavioral change and digital transformation are heating up

across wealth management - particularly among those that service

the lucrative high net worth segment.

Firms that dedicated energy and resources pre-pandemic on

developing a strong digital experience and innovative tools have

since reaped the rewards with elevated engagement and higher

client satisfaction scores. Those that did not have the benefit

of hindsight and the option to use other firms’ roadmaps to

advance their digital propositions.

Far from seeking a return to the white glove service, high net

worth clients want their wealth managers to focus on improving

the multi-channel experience and bridging the gap between

in-person and virtual relationship management.

.png)