Compliance

US, UK Are Top Global Money Laundering Hotspots

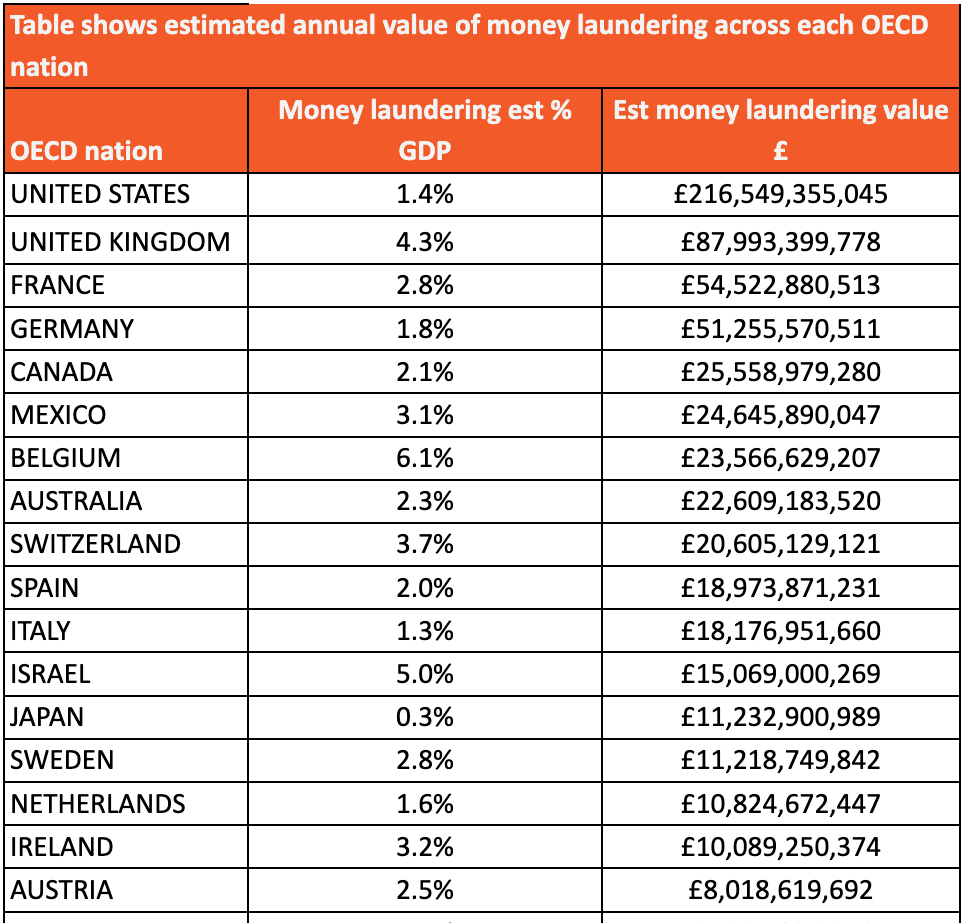

The UK and US top the list of global money laundering hotspots, with experts maintaining that prevention is better than cure for the global scourge.

The UK ranks second among global money laundering hotspots, with

an estimated £88 billion ($119 billion) laundered each and every

year.

In the US, the figure stands at £216.5 billion laundered every

year, by far the highest sum among OECD (Organisation for

Economic Co-operation and Development) countries.

It is estimated that worldwide, the total sum of money laundered

annually equates to as much as 3 per cent of global GDP – a

huge £1.8 trillion, according to new figures from identity

verification service Credas.

Among OECD member states, the sum of money laundered in the UK is

estimated to sit at 1.9 per cent of GDP, although this climbs as

high as 6.1 per cent in Belgium, with the UK sitting fourth in

the table at 4.3 per cent. However, when taking the GDP of each

nation into account, the UK jumps to second in the table, with

this 4.3 per cent of GDP equating to a huge £87.9 billion of

money being laundered annually.

France (£54.5 billion), Germany (£51.3 billion) and Canada (£25.6

billion) also rank within the top five. In contrast, Iceland

sits at the bottom of the OECD rankings, with just £370

million in money laundering value, followed by Estonia

(£703.4 million) and Latvia (£750 million).

“The practice of money laundering is as old as the hills and it’s

one area of criminal activity that is incredibly tricky to

eradicate as it can be done in such a vast and varied number of

ways,” Tim Barnett, chief executive officer of Credas

Technologies, said. “It’s also a practice that continues to

evolve with the times and in more recent years we’ve seen

criminals utilise online banking, cryptocurrencies and, most

recently, NFT marketplaces, in order to wash dirty cash."

"Prevention is always better than cure and our technology is

deployed the length and breadth of the nation and across a

multitude of sectors to ensure that businesses are safeguarded

against this illegal activity," he added.

There have been a series of global money laundering scandals,

including the worst one in Asian financial history, 1MDB, which

resulted in Singapore removing the local licences of two

banks – BSI and Falcon Private Bank. Just this week a former

Goldman Sachs banker has gone on trial accused of

misappropriating more than $2.7 billion dollars from the

Malaysian fund, embezzling the money to purchase luxury real

estate and art, as well as to finance Hollywood films.

Separately, the UK’s financial watchdog fined NatWest £264.7

million in December for failing to follow AML regulations.

Money laundering is measured in trillions of dollars, creating a

headache for banks and other intermediaries. The amount of money

laundered annually stands at $1.6 to $2 trillion; less than 1 per

cent of this laundered money is traced, according to New

York-based Broadridge Financial Services.

As a result, banks spend a lot of money on regulatory technology to ensure that their onboarding, KYC and anti-money laundering procedures are rigorous and fit for purpose. But many wealth management firms are still over-reliant on manual compliance checks for processes such as KYC and anti-money laundering, and have no plans to automate, according to LexisNexis Risk Solutions.