Asset Management

Institutions Take Chips Off The Table

The data shows how these government-backed organisations, overseeing trillions of dollars in assets – sometimes created by energy wealth – are changing their risk appetite. Latest figures suggest that they are being more cautious.

Institutional investors such as sovereign wealth funds

– which in some ways resemble family offices in their

investment habits – have taken risk off the table as central

banks have started to hike rates reacting to geopolitical worries

such as Russia’s invasion of Ukraine.

The findings come from State Street and the

International Forum of Sovereign Wealth Funds (IFSWF), a global

network of sovereign wealth funds from 40 countries.

Collectively, State Street looks after more than $43 trillion of

assets as a custodian and administrator for SWFs.

Based on State Street’s Behavioural Risk Scorecard, sentiment

turned negative in February, falling to the lowest point in two

years.

“As economies around the world emerged from the long shadow cast

by the Covid-19 pandemic, investors are faced with new risks.

Today, risk assets are re-pricing due to international conflict,

inflation, and central bank policy responses,” Neill Clark, head

of State Street Associates, Europe, Middle East and Africa (EMEA)

said.

“Following a period of opportunistic rebalancing and selective

risk-taking during 2020, the past year has seen institutional

investors moving towards safer assets and markets. Their asset

allocation decisions suggest they are no longer adding to their

equity exposure – which they had been doing since Q1 2020 – and,

instead, are adding to their fixed-income and cash balances,”

Clark said.

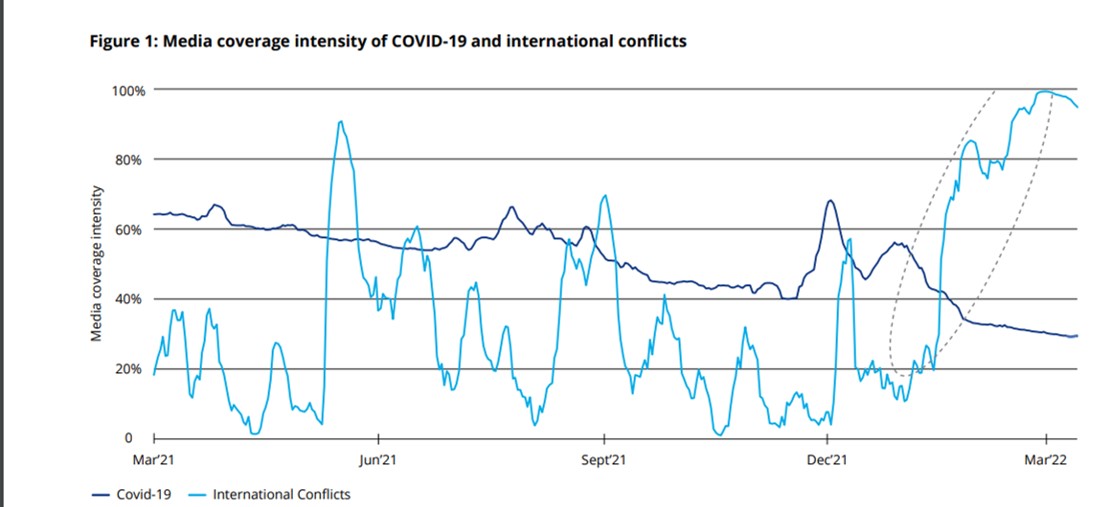

The following chart highlights how media focus on the pandemic gradually flattened off and declined in recent weeks (in most regions) while the coverage of conflcts, most obviously Ukraine, rose rapidly.

Source: State Street.

The new report reveals that strong capital outflows from emerging

markets – the largest level of selling observed over the previous

five years – have been matched by robust demand for stocks in

developed markets.

“When it comes to the investment strategies of sovereign wealth

funds, most are taking the long view, which can sometimes mean a

contrarian stance,” Duncan Bonfield, chief executive, ISFWF,

said. “For example, one of our members has increased its

emerging-market equity positions as the value/price gap widened,

as emerging-market equity was cheaper than it was six months ago

relative to its fair value estimates.”

In fixed income, the report reveals that heightened geopolitical

risk has seen capital outflows from emerging-market sovereign

debt, while high-quality, developed-market sovereign bonds are

maintaining stable capital inflows despite rising domestic

inflationary pressures.

Euro and US dollar-denominated corporate credit has also seen

outflows, driven by a challenging combination of rising rates,

high inflation and slower growth, tapering of quantitative easing

from global central banks, and potential ripples from Russian

sanctions as well. One beneficiary of the credit uncertainty and

rising inflation pressures is the US Treasury Inflation-Protected

Security (TIPS) market, where there has been renewed appetite

from institutional investors, who also favoured currencies which

displayed less negative exposure to the developing international

conflicts.