Family Office

Is There Life For Startups After Rate Rises, SVB's Collapse?

The following article examines what has happened to funding of venture capital investments after the demise of Silicon Valley Bank in March. SVB, as its name implies, was closely linked to the startup world, and many of its clients had made their fortunes in tech and related fields. Would the end of this bank mean the taps of funding get turned off? Where else will funding come from?

To examine how severe the crunch might be, and explore the role of family offices as purveyors of “patient capital,” is Alastair Graham, CEO and founder of Highworth Research. Highworth is a comprehensive database of single-family offices around the world. This news service is exclusive media partner to the business. (To register for the database, click here.)

Times are tough these days for early stage companies looking for

funding. Crunchbase reported that venture capital funding had

plunged from $162 billion in the first quarter of 2022 to $76

billion in the first three months of this year. The clouds were

already gathering in 2022 – GP Bullhound, a tech investment firm,

found that debt issuance to European tech companies doubled to

€30.5 billion ($33.7 billion) in 2022 compared with 2021. This

was endorsed by Dealroom’s finding that debt accounted for around

30 per cent of all venture capital raised for European tech

companies in 2022 compared with an average of 16 per cent in the

previous six years as equity investors reduced their commitments.

Astonishingly, SVB was responsible for 60 per cent of all venture

debt raised in California in 2023 up to the date of its

failure.

In step with interest rate rises, and more restricted funding

from venture capitalists, valuations for young tech companies

have headed south. So they have to conserve cash, grow more

slowly, cut back development, or raise money at lower valuations.

In a worst case, bankruptcy may beckon.

Fundraising for startups is not all gloom

But the gloom can be overdone. One aspect of the problem facing

startups and early stage growth companies is that many are

conditioned primarily to knock on the doors of venture capital

companies and not look at the wider market for raising risk

capital. Within that wider market an important source is single

family offices.

However the problem is that family offices are much harder to

identify than VC fund managers. As a group they are opaque, only

dimly visible, cannot be found in easily accessible professional

associations, and do not conform to a standard type.

Family offices as a robust source of VC

funding

Yet the journey to family office funding is worth making for many

young companies with promising growth prospects. There are good

reasons for this, including:

- There is wide availability of VC funding from

single family offices;

- Family offices are not themselves dependent

on external funding, their capital is invariably

evergreen;

- Single family offices as a sector have

continued to grow rapidly in numbers over the past 15

years;

- Family office VC funding generally represents

patient capital, a willingness to invest for the longer

term;

- Many single family office principals like to

invest in business sectors which they themselves know well and

often where they have made their own fortunes. So the quality of

management support for the startup may be strong in terms of

recommending business model adjustments, market entry processes,

useful contacts, errors to avoid, and the like;

and

- Venture capital investment is among the most

popular asset classes to which family offices allocate their

capital.

However the problem remains that data on single family offices,

and an efficient, professional way to access the market, are hard

to identify.

How to source VC funding from family offices

efficiently

One potential solution is to use the Highworth Single Family

Office Database, an online database with global scope which has

been painstakingly developed over the past 15 years by Highworth

Research of London.

The Highworth Single Family Offices Database currently provides

detailed profiles including contacts at over 2,160 single family

offices globally. It can be interrogated using a range of search

filters which are able to identify those family offices which

conform to an enquirer’s specific criteria.

There follow some tables derived from the database which

illustrate why single family offices should be seriously

considered as a source of funding for early stage growth

companies.

The majority of family offices globally are VC

investors

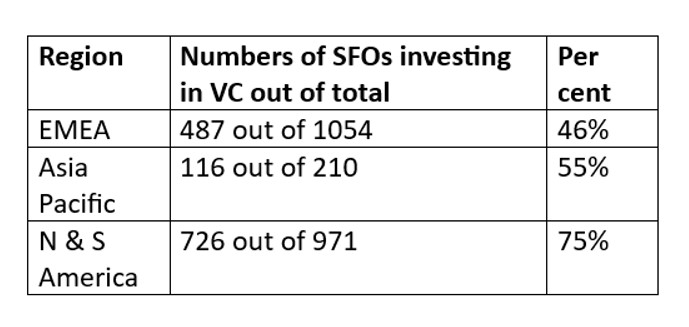

The Highworth Database shows that 59 per cent of single family

offices globally, or 1,282 out of 2,163, invest in venture

capital. VC is the fourth most popular asset class to which

capital is allocated, after equities (79 per cent of family

offices), real estate (68 per cent), and private equity (60 per

cent).

Within VC, 36 per cent of all single family offices on the

Highworth Database invest in technology, with consumer products

and services being the next most popular sector at 28 per cent,

and then business services at 17 per cent.

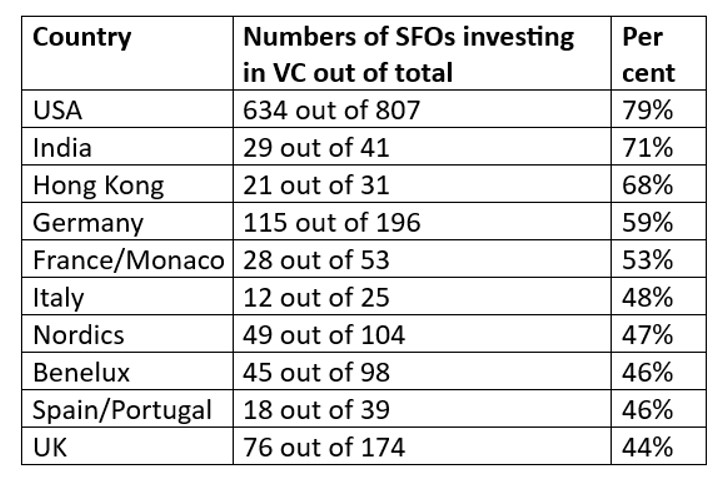

However the opportunities for fundraising from single family

offices vary markedly according to the region or country.

Europe is clearly the least favourable region in which to raise

VC funding from family offices, with a young growth company

having a much better chance of securing funding in North

America.

Which countries offer the most favourable VC fundraising from

family offices?

Family offices at the forefront of venture capital

funding

Many family offices stand out as savvy investors, buoyed by a

history of personal entrepreneurial success in specific business

sectors, and with proprietorial and patient capital that’s not

dependent on the vagaries of external fundraising or the pressure

to sell within a set time period.

Financing scientific discovery is a long game in investment terms

and the risk of failure is great. Single family offices may be

well suited to this type of patient capital, but only a tiny

fraction will achieve off-the-chart success. Here are a few of

the many:

• Athos Service GmbH, Germany

Athos KG is the family office of the brothers Andreas and Thomas

Strüngmann. Through the family office’s investment vehicle AT

Impf the brothers first invested a €136.5 million seed round in

2008 in a tiny startup called BionTech. Today, everyone knows

what happened to BionTech and its partnership with Pfizer to

produce the Covid vaccine. On 13 April 2023 BionTech’s

market cap was $31.24 billion with Athos, still the largest

shareholder through AT Impf, holding 43.5 per cent. The stake is

valued at $13.58 billion, among the very highest value holdings

in a single company in any European or US single family office’s

VC portfolio.

• Carl Bennet AB, Sweden

Carl Bennet AB is the family investment company of Swedish

industrialist Carl Bennet. There are just six companies in the

private equity and VC portfolio of Carl Bennet AB. Of these, the

longest held (since 1989), the largest by sales revenue, and the

most valuable, is Getinge AB, a manufacturer of sophisticated

medical equipment for hospitals.

The company’s market cap on 13 April 2023 was SEK 70.4 billion ($6.8 billion), valuing Carl Bennet’s 20.03 per cent stake at $1.36 billion. Bennet has patiently held the stock for 34 years, unthinkable for a venture capital fund but not unusual for a multi-generational family office.

• Aprés-Demain, Switzerland

Aprés-Demain is the unusually named family investment company of

Thierry Mauvernay, a second generation member of a Swiss family

whose wealth stems from the founding in 1979 of Debiopharm, a

successful pharmaceutical company. Aprés-Demain invests in a

diversified range of asset classes, with its venture capital

portfolio focused currently on 17 digital health companies, which

include two further investments just last month. Since digital

health is in the DNA of the family behind Aprés-Demain, adverse

short-term economic cycles are unlikely to frustrate the strong

pace of the firm’s VC investment activity.

• Crosby Advisors, US

Crosby Advisors is the family office which manages the assets of

the Johnson family which owes its wealth to the founding in 1946

of Fidelity Management & Research by Edward Johnson II. Today

Fidelity is the second largest mutual fund manager in the US.

The Johnson family’s VC investment activity is undertaken through

a Crosby affiliate F-Prime Inc. F-Prime’s global portfolio

currently holds nearly 300 companies in healthcare and technology

sectors to a present value of around over $4.5 billion, one of

the largest family office portfolios dedicated to venture

capital. F-Prime is not too concerned about temporary setbacks in

the economy not least because, as the firm comments, it is

“without the pressure of fundraising from outside investors.”

• Chan Zuckerberg Initiative, US

The Chan Zuckberg Initiative represents the family investment

company of Mark Zuckerberg, founder of Facebook, and his wife

Priscilla Chan. The firm is an example of a private investment

company funded by a multi-billionaire who, although affected by

turbulence in the wider economy (current Facebook layoffs),

nonetheless ploughs on with venture capital investment because it

represents a public commitment to philanthropy. Most of the Chan

Zuckerberg Initiative’s allocation to VC is invested with an

impact purpose, intended to yield a profit but at the same time

to achieve a social benefit.

• Souter Investments, UK

Souter Investments is the family office of Sir Brian Souter,

co-founder of Stagecoach, the UK’s largest bus company. Now

retired from Stagecoach and no longer a shareholder, Sir Brian's

major focus now is as a direct private equity investor with the

ticket size range being £2 million up to £40 million – a range

which at the lower level he could also be considered as a late

stage venture capitalist.

In 2022 the non-listed segment of Souter Investments’ portfolio,

predominantly focused on direct investments in growing private

companies, grew 52 per cent in value from £183 million to £278

million. The firm’s pre-tax profit, reflecting the growth in

value of the firm’s listed and unlisted investments, rose 67 per

cent from £42.9 million ($53.5 million) to £71.7

million.

These growth rates make it probable that Souter Investments will

accelerate rather than reduce its current VC funding and that

high interest rates or macro-economic uncertainty are unlikely to

slow this down.